Just a quick update before I head out to dinner.

The first trading day of the month generally leans strongly bullish, but as I mentioned on twitter last night, that’s not the case in August, closing green about 33% historically and with SPX closing down five of the last six.

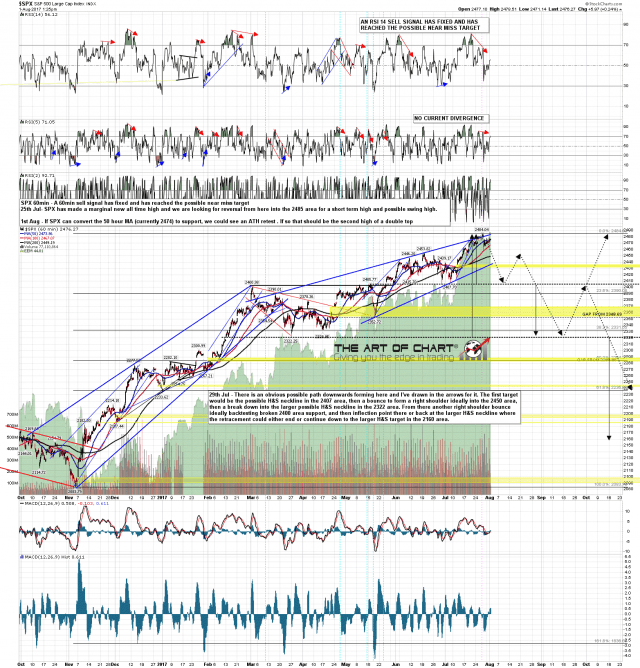

ES has been trading mainly above the weekly pivot so far this week, but hasn’t yet convincingly converted that to support yet. NQ and TF spent most of yesterday and all of today under their weekly pivots, and if ES/SPX retests the all time high to make the second high of a double top, that should be doable without either NQ or TF breaking back over their weekly pivots. I wouldn’t be surprised to see that retest.

Tomorrow and Thursday are cycle trend days, and if we are going to see the obvious next leg down, then it makes sense it would be then.

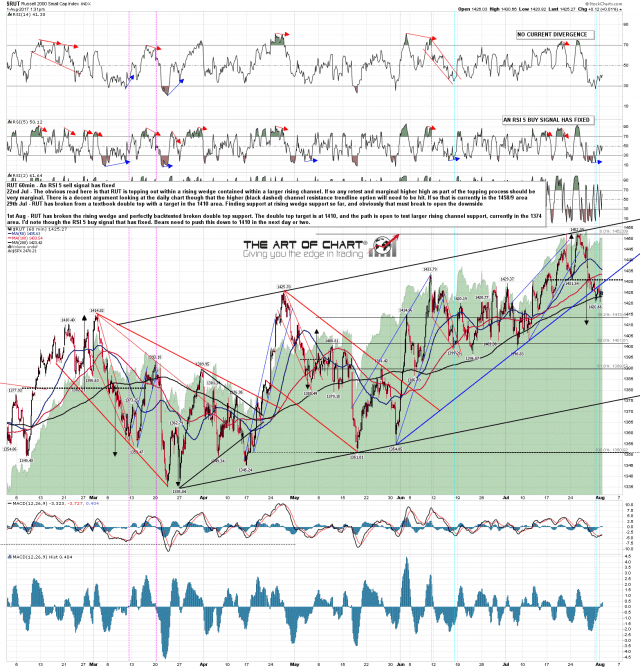

On RUT the rising wedge has broken and broken double top support has been backtested perfectly. The double top target is at 1410. I’d note that an hourly RSI 5 buy signal has fixed and RUT needs to start the next leg down soon. RUT 60min chart:

If SPX can convert the 50 hour MA to support then that opens the way for a possible all time high retest. If seen I’d expect that to be the second high of a small double top that on a subsequent break down would look for the 2435 area. SPX 60min chart:

AAPL is reporting earnings after the close tonight and if that delivers a retest of the all time high on AAPL that would improve the high there.