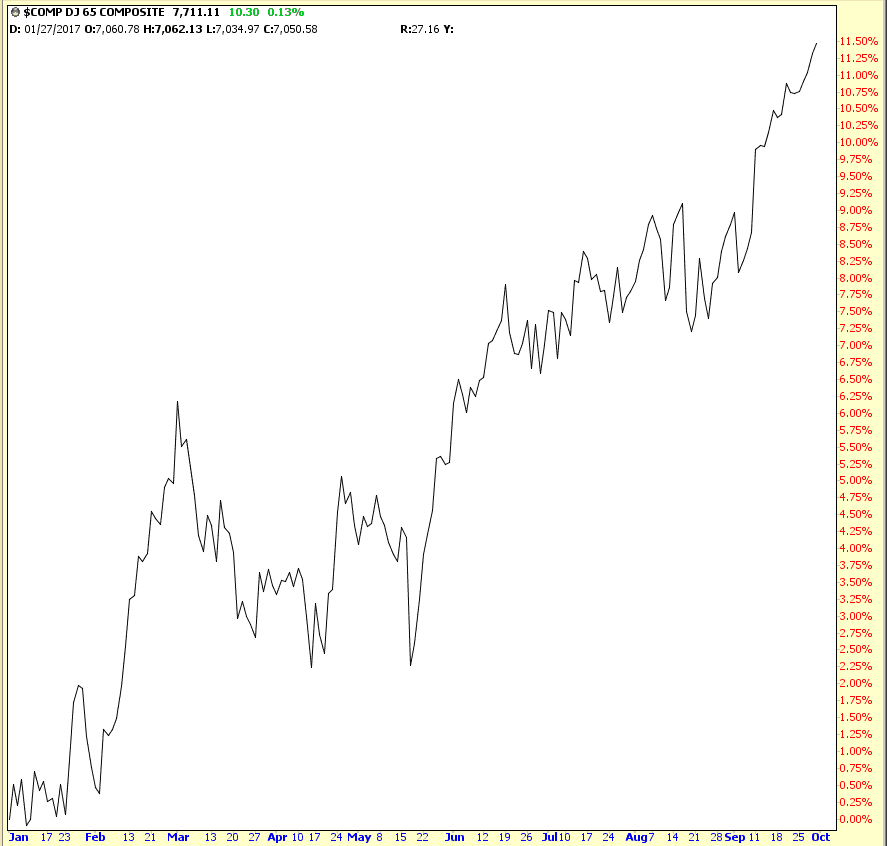

As we close out September, the bearish month of the year (ha! woo ha! ha ha ha!) and, in turn, the third quarter, let’s see where the big indexes stand percentage-wise in 2017. Here’s the Dow Composite:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Lifetime Highs Bar

Swing Trade RCI FANG QGEN

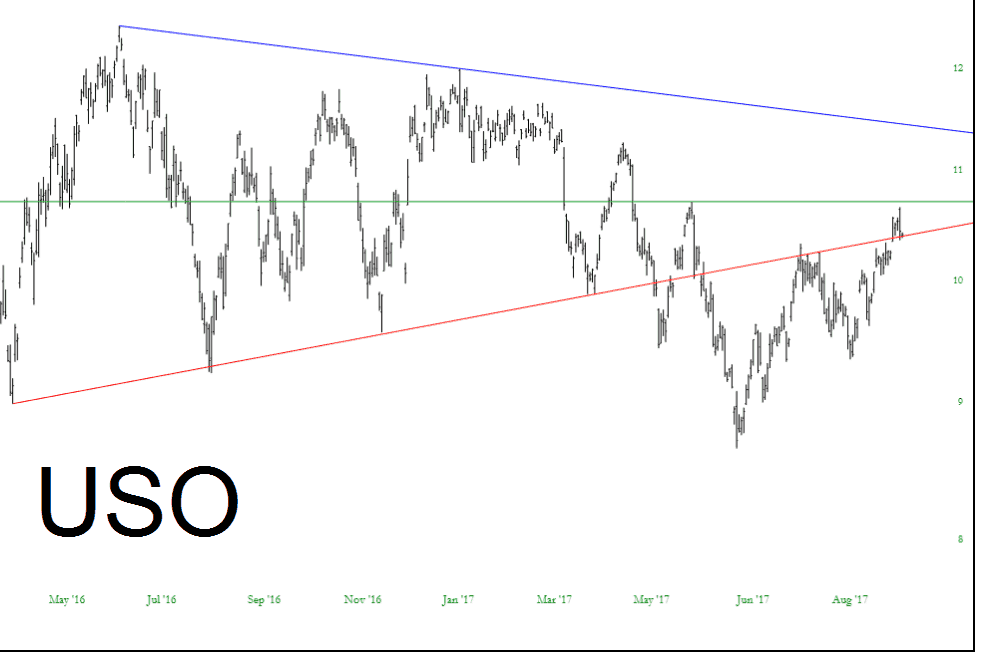

Oil’s Triangle

Oil, as represented by the USO fund below, had been inside a symmetric triangle for many months. It had broken beneath it, but it’s managed to claw its way back up inside. The dividing line is at $10.70, which is just about the midline of the triangle. Breach that, and oil will gather even more strength. Fail to do so, and it’s at risk of slumping beneath this large pattern again. I remain bearish oil and short energy stocks. I also own January puts against XOP.