Other than on asian markets, there is a lot of negative divergence on US and european indices on the weekly and daily charts now, with the first of those fixing on the RUT and FTSE daily RSI 5s this week.

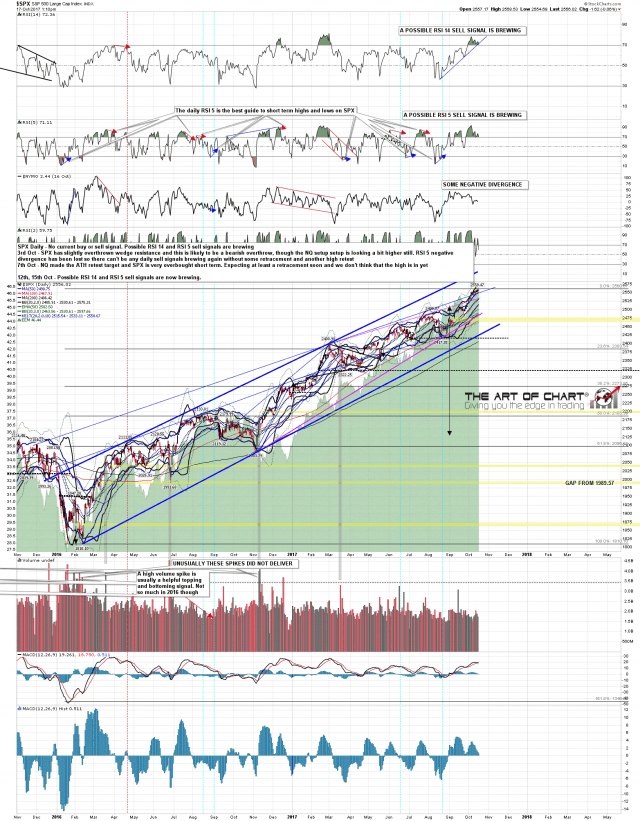

SPX has possible daily RSI 14 and RSI 5 sell signals brewing, one half decent red daily candle would likely fix both signals. SPX daily chart:

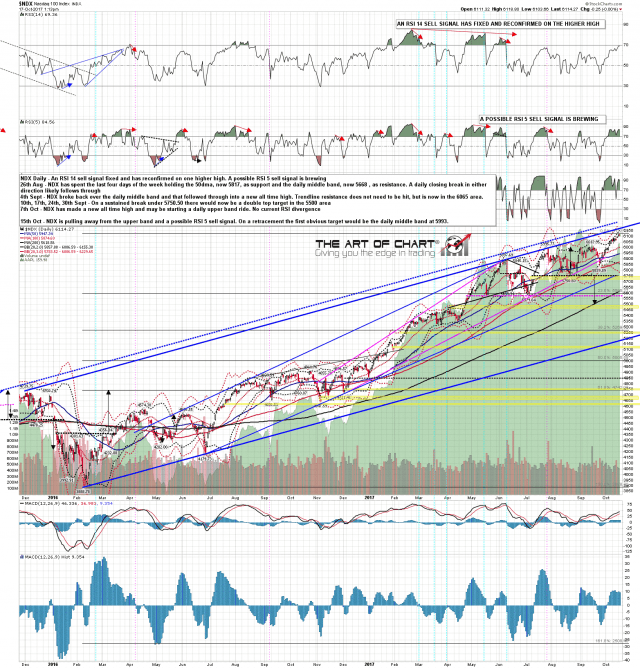

On NDX a daily RSI 14 sell signal fixed months ago and is of no immediate interest. A shorter term RSI 5 sell signal is brewing there and NQ reached Stan’s target at 6125 yesterday. NDX daily chart:

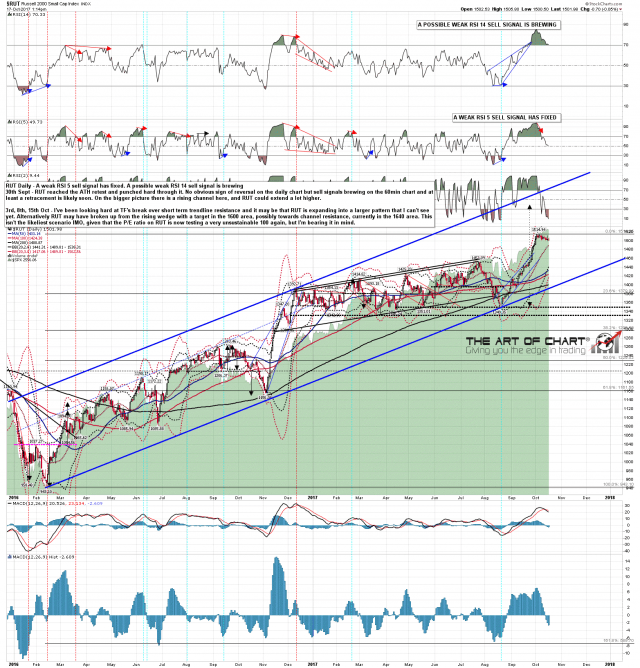

A possible weak RSI 14 sell signal is brewing on RUT, and a weak RSI 5 sell signal has already fixed. A likely bull flag has been forming over the last few days and a retest of the all time high is likely before reversal. RUT daily chart:

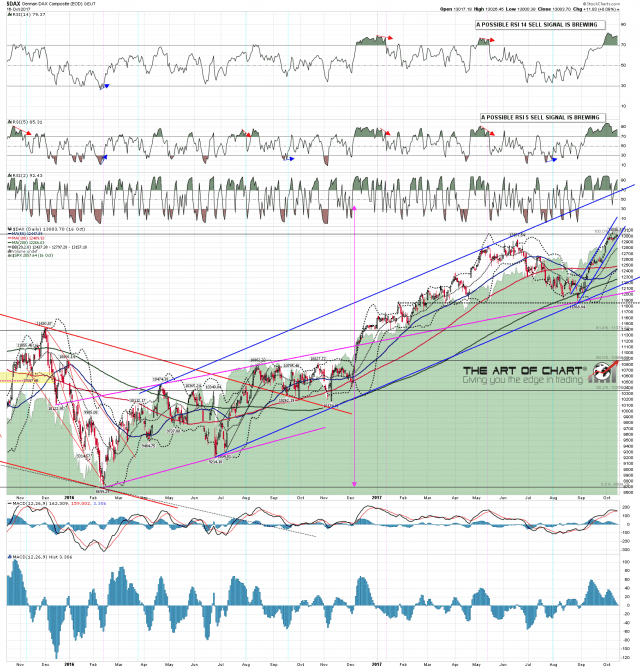

On DAX both RSI 14 and RSI 5 sell signals are brewing, though the overall pattern setup is suggesting unfinished business above. DAX daily chart:

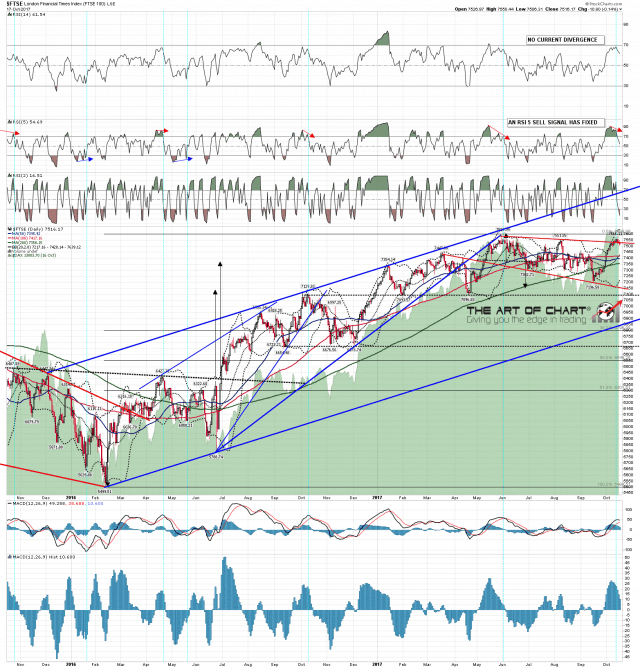

On FTSE a daily RSI 5 sell signal has fixed but there is also an open bull flag target at a retest of the all time high. That target should be hit before any serious reversal. FTSE daily chart:

At least some retracement should be close here, and that could develop into something impressive. If seen, we likely see that swing high in the next few trading days.