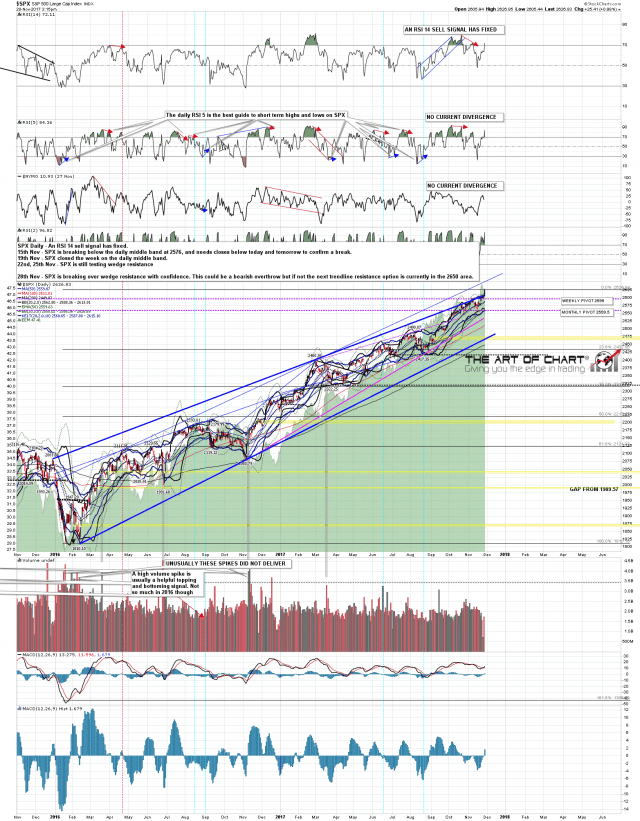

Bears really haven’t made a significant impression on equity indices this year (Editor’s Note: no kidding…..….) and, statistically, there’s not much reason to think that might change in the last month of the year. One key trendline that I have been watching is the very decent looking rising wedge resistance from the 2016 low and that has broken up with some confidence today. That could still be a bearish overthrow, but that seems doubtful. More likely SPX is heading to test the next decent trendline option, currently in the 2650 area. SPX daily chart:

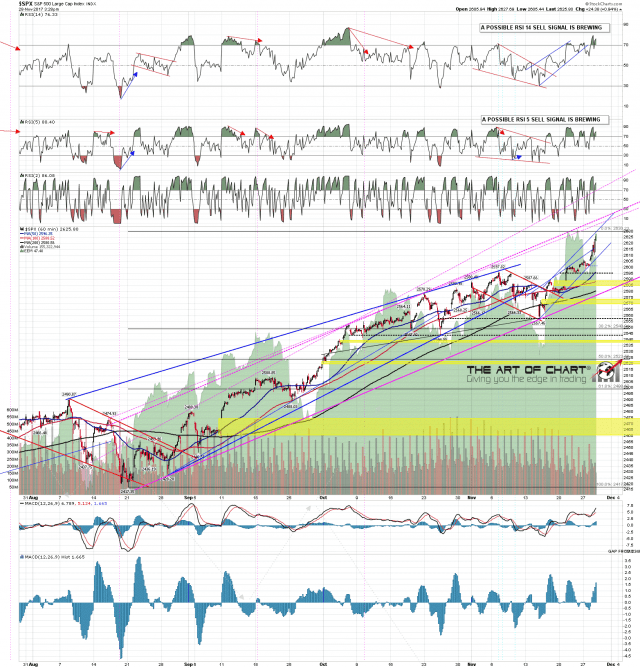

In the shorter term the rising wedge from the August low is likely expanding into a larger pattern. I’ve drawn in the three most likely resistance trendlines and the first two are bracketing the 2640 area. We’ll see what happening when they are reached. Possible hourly RSI 14 and RSI 5 sell signals are now brewing. SPX 60min chart:

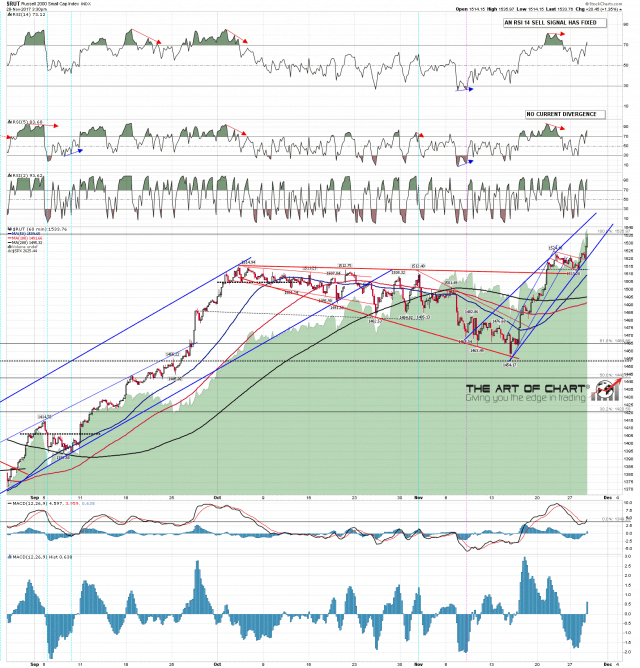

On RUT I’m watching a possible rising wedge with wedge resistance currently in the 1545 area. RUT 60min chart:

Where is all this going? That’s hard to say but with the exception of the last trading day of November on Thursday there are no historically bearish leaning days left in 2017 until the last trading day of December. There may not be a significant pullback before January.