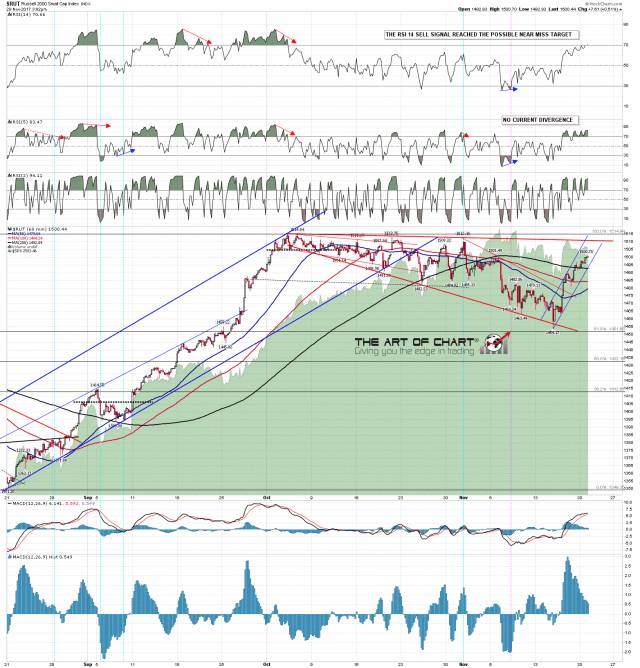

A very key pattern that I’ve been watching here for direction is the likely falling megaphone on RUT.This has been a slow developer and has now been forming for an impressive seven weeks. Assuming that this is indeed a falling megaphone then the next target within the megaphone is megaphone resistance, now in the 1511 area, with the main remaining obstacle on the way at the monthly pivot, at 1500 even and tested at the highs today.

Assuming that this is that falling megaphone, then that falling megaphone is a high probability bull flag pattern, and when that breaks up the minimum target will be a retest of the all time high at 1514.4.If that retest can be kept to a marginal higher high then that is the bears’ next decent shot at a larger retracement, though seasonality makes it questionable that we would see that retracement in what remains of 2017. RUT 60min chart:

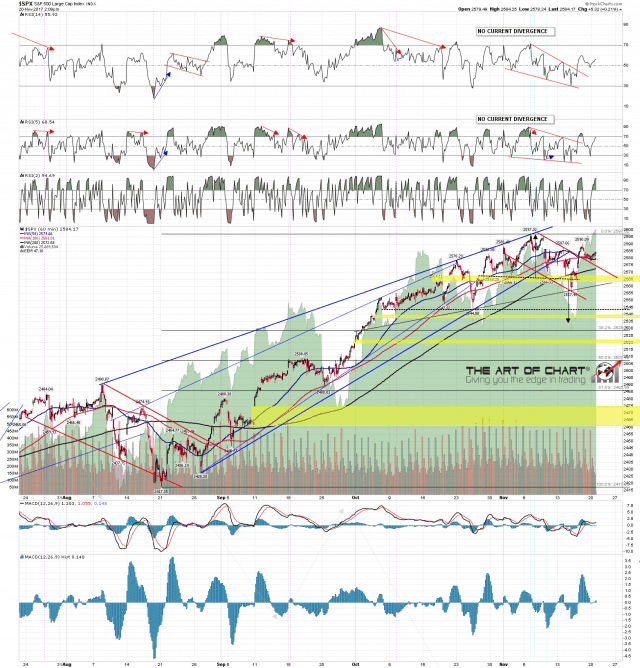

A bull flag channel has already broken up on SPX and has backtested broken flag channel resistance on Friday and Monday. The retest of the ATH is a high probability target, supported as well by the falling wedge that has broken up on the RSI 14 with a high probability target at the 70 level on the RSI 14. I’m expecting the ATH retest on SPX close to the ATH retest on RUT on the performance of each from last week’s low. SPX 60min chart:

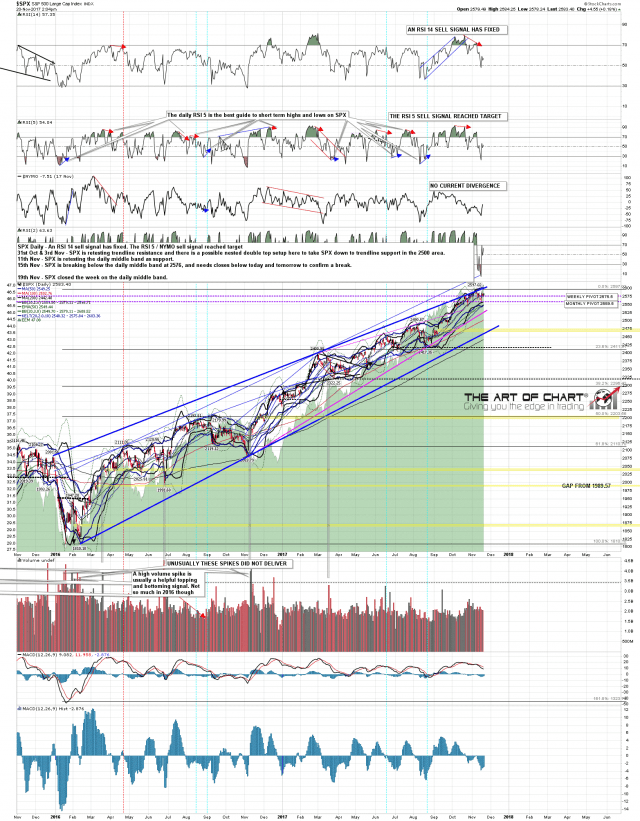

On the daily chart SPX has also been backtesting the daily middle band as support and that’s holding so far. As long as that remains the case on a daily close basis then the next target is the daily upper band, currently slightly above the all time high at 2597.02. SPX daily chart:

This is likely to be a low volume holiday week and we may not see a lot of movement, but the next main targets should be these all time high retests, and any dip on the way there should be a buy. When we see those retests we’ll see what happens, but I’d note that the only remaining days in 2017 with a significant historical bearish bias are the last trading days of November and December.