Before I begin, I want to mention we’ve substantially improved the quality and speed of our real-time index data, so you SlopeCharts users will immediately start enjoying the improvement.

I promise to only mention it a few thousand more times, but please note my new book has out (which just got its first review!) so please check it out.

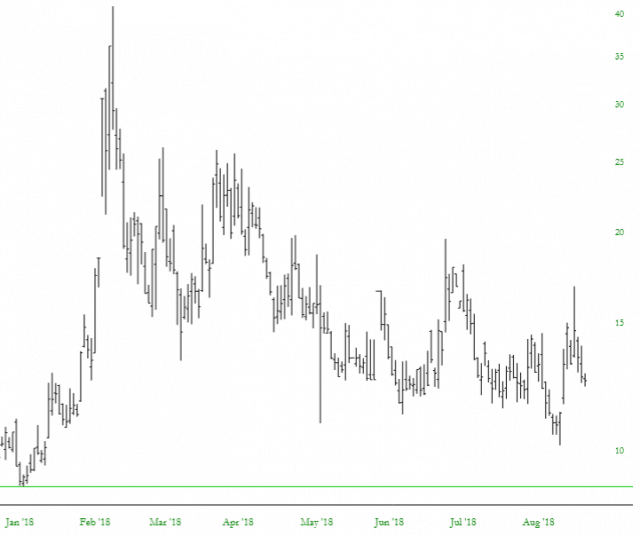

As for the markets, it’s pretty much what I predicted/dreaded last Friday, which is a continuation of the “melt up”. Barring some shock event (e.g. China announces the U.S. can go screw itself, and the trade war is back on) it seems the natural path of the market is simply going to be higher – – – which, let’s face it, makes sense, since it has only been going continuously up for the past nine years. Volatility is, once again, completely dead, which makes for a market more boring than words can describe:

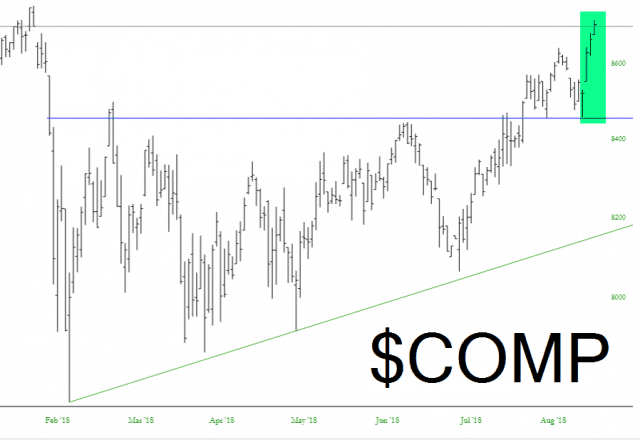

The Dow Jones Composite shows, via that green tint, how swiftly the Turkish debacle was dispatched. We are just one decent day to new LIFETIME highs.

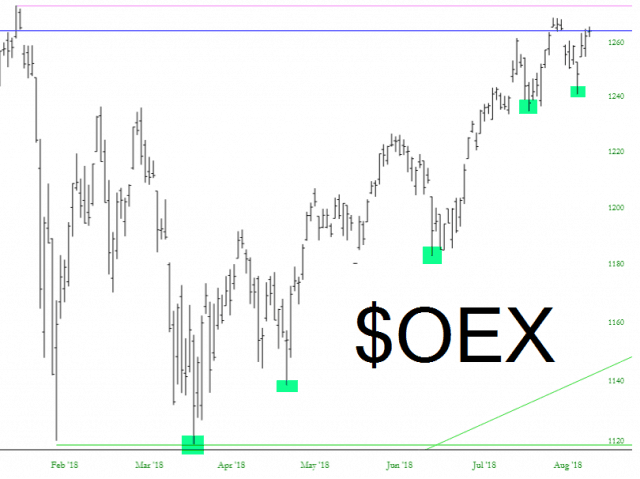

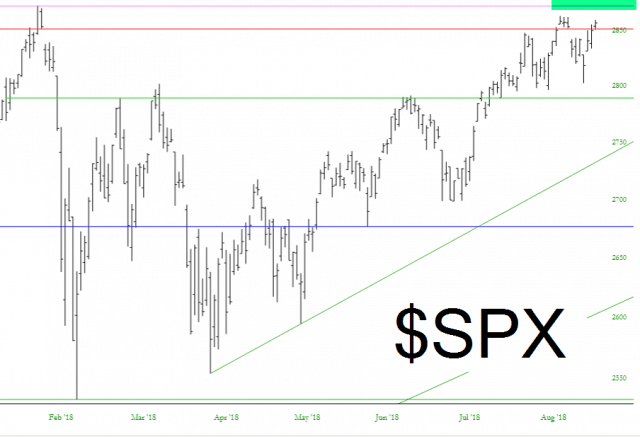

Same deal with the S&P 100 (and everything else, actually). Look at that series of higher lows – – shallower and shallower dips, and stronger and stronger rallies.

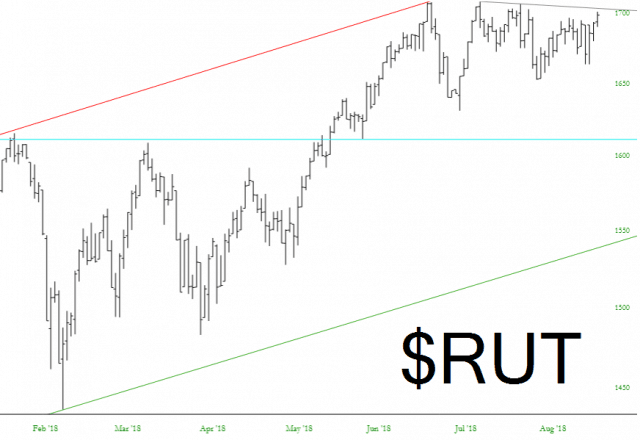

The small caps are a little tougher to divine. It has been losing a little steam over the past couple of months, but it, too, is just one solid day away from breaking free of this and hitting a new lifetime high.

x

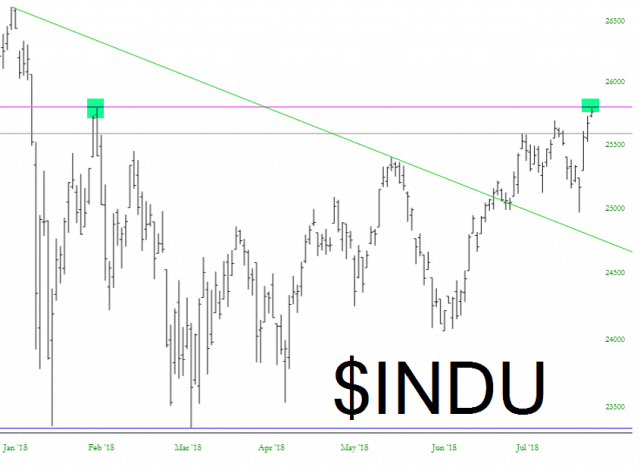

The Dow is just a hair’s breadth away from pushing past its own horizontal. And keep in mind, all this excitement is without ANY news. If, for instance, China announced some positive news for the U.S markets, the Dow could easily rip 500 points higher.

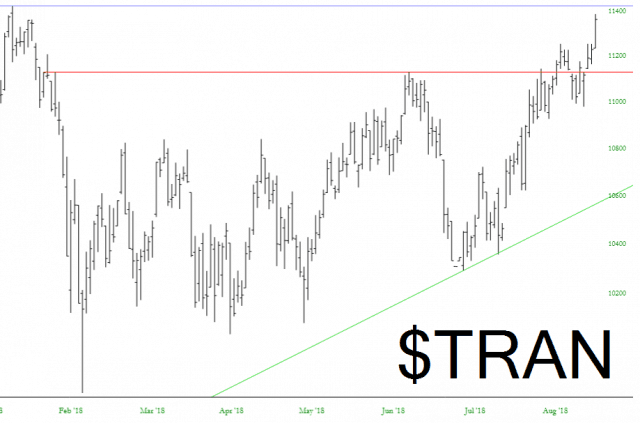

Although the Industrials is still many hundreds of points away from a lifetime high, the Dow Transports is a pebble’s throw away. That blue line marks the highest levels in history, and we’re just about past it. We could well open above it first thing in the morning, barring famine, flood, or fire.

It’s all quite depressing for the one or two bears left, although after nearly a decade’s worth of torture, I suspect the one or two of us remaining are well past the point of numbness. The wrenching drop that took place for those precious few days in early February is an ancient memory now, and the state-sponsored, global equity orgy is showing, in its 10th year, no sign of being the least bit weary.