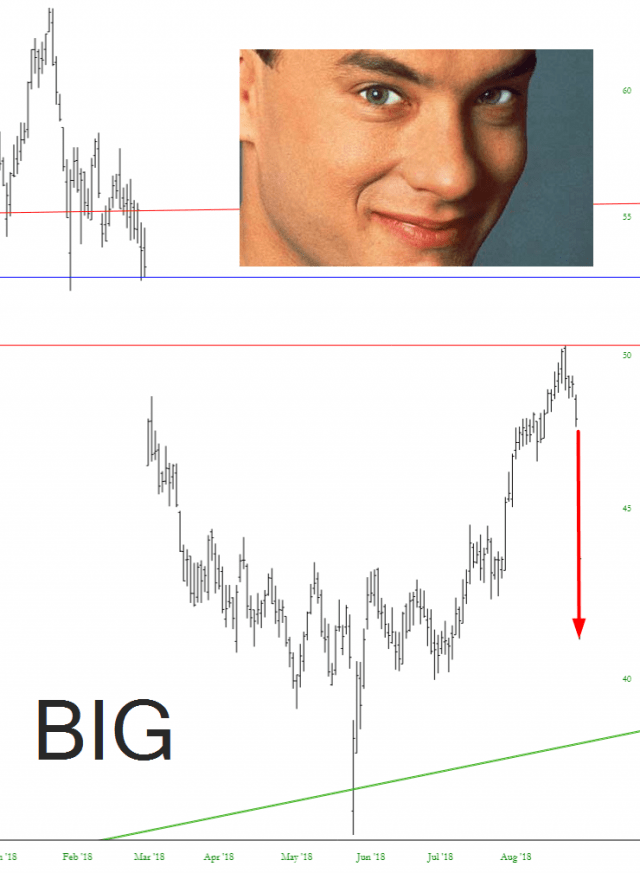

It was only yesterday that I did this post suggesting shorting Big Lots. Satisfaction didn’t take long.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Oh What a Friend We Have in G-Sus

In case there are one or two naive souls out there who don’t think the equity markets are completely controlled by the central bankers, look no farther than precious metals. They have been in a full-on bear market for seven years. Seven. YEARS. What’s the longest equities have been allowed to fall in the past few years? A week. That’s all the powers that be can take.

Incredibly, even though yesterday we were down, we’re actually red at the moment I’m typing this too. So – – maybe two days could get under our belt! Who knows. But if things are permitted to slip a little, the measured target seems to be just above 2870.

Break Like the Wind

If there’s one thing I can show to swiftly illustrate the madness of the equity markets, it is the SlopeChart below. It represents Amazon’s trio of exponential moving averages (50, 100, 200). As you can see, there hasn’t been a single downside crossover………in THIRTY MONTHS. This, my friends, is what a one-way market looks like (and how a company gets to a trillion dollar market cap).

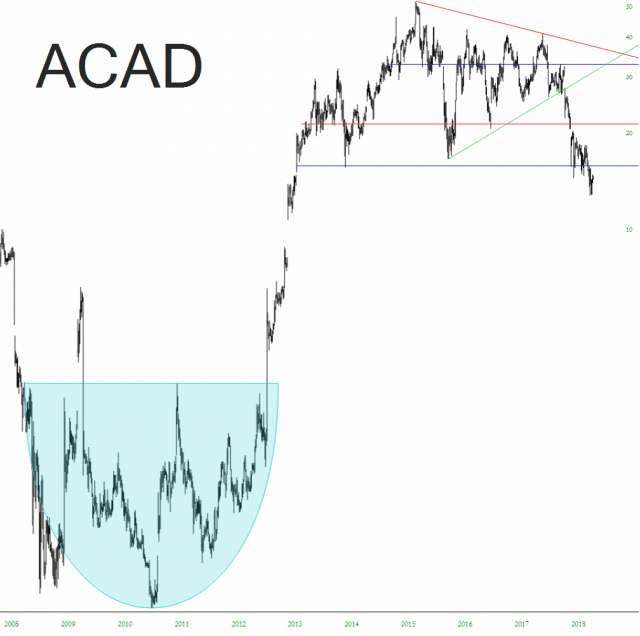

Mirror Image

Given the success of recent picks lately (DLTR, BIG, TROX) I wanted to share another intriguing short setup, which is Acadia Pharmaceuticals. Its topping pattern right now seems to mirror perfectly its basing pattern from years ago. I anticipate much lower prices in the months ahead. Apparently their big product is a drug that combats hallucinations. This market could sure use some of those pills.

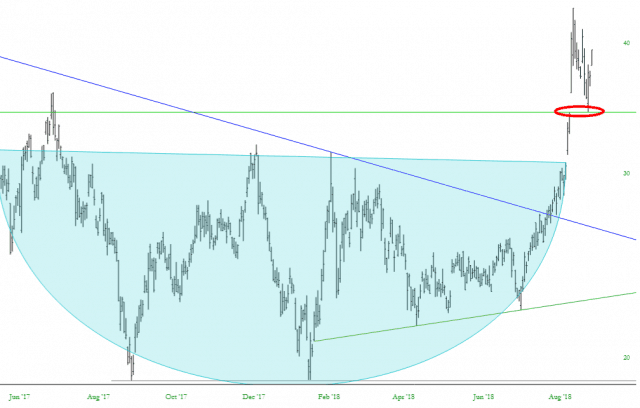

Dust-Up Follow-Up

Just yesterday I was mentioning the very smooth basing power of ultra-bearish fund DUST, shown below. I’ve circled the price gap. It is adding to its gains from yesterday. It just seems the so-called precious metals sector, after seven years in its own bear market, can’t get up off the carpet.