OK, I’m so sooooooooo sorry to mention it again, but I am absolutely crazy about the new Arc drawing tool in SlopeCharts. I’ve been spending the entire morning sexing up my charts with these things. You’ve got to try them out!

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Next Question

What’s Next for Gold?

Gold is taking a bit of a breather after earlier climbing to a new recovery rally high at $1220.70 in the December futures (GC), a full $53.60 and 4.6% off its August 16, 2 1/2-year low at $1167.10.In a very bullish set-up, gold (GC) should digest recent gains above the $1207 area, where the 5 DMA has just crossed above the 20 DMA. However, if $1207 is violated and sustained, then we should expect gold to press into a deeper correction of its $53.60 rally, towards the $1195-$1190 support zone, which MUST contain the weakness to avert a complete retrace of the August advance.

If either the shallow ($1207) or deeper ($1195/90) corrections unfold, the subsequent upleg will point to $1250.00.

(more…)

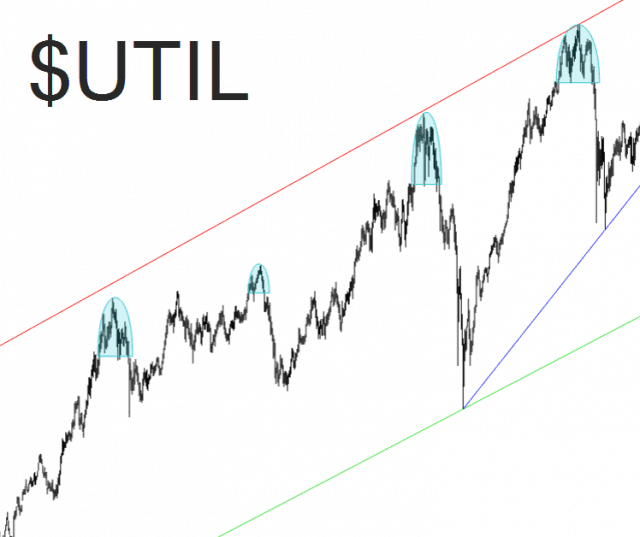

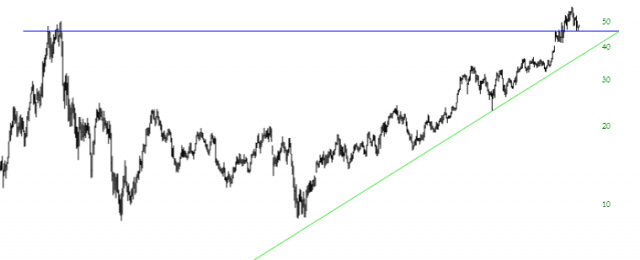

Arcs and Recreation

I am pleased to let you know of another improvement to SlopeCharts: arcs.

Rounded tops and rounded bottoms are very important basic instances in the world of charting. Intel, for example, shown below, has a very well-formed saucer pattern, but until now, it wasn’t really possible to highlight in SlopeCharts. You could use the rectangle highlight tool, perhaps, but that’s not really the right shape, or you could, as I did, just drawn some carefully-placed trendlines:

Control Top

Before I get started, I wanted to mention that I just received the full-color version of Silicon Valley Babble On, and it is just gorgeous. If you’re one of the well-to-do Slopers out there, you might want to spring for this luxury item, because it looks absolutely fantastic. It’s not cheap at 79.95, but here’s a link if you’re interested.

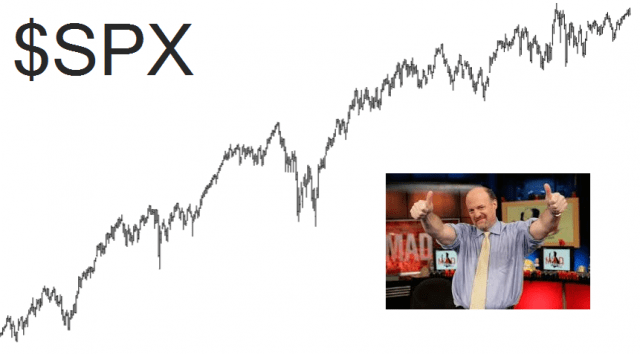

Now I’d like to share with you three charts of the S&P 500 cash index. I have deliberately left off the axis labels, so you’ll know neither the times nor the prices.