We began tracking this negative divergence in NFTRH last year as the leadership of two premier Semi Equipment companies began to decelerate vs. the broad sector.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Just a Coupla Charts

I wanted to share a couple of charts that have little to do with one another on this records-highs-are-everywhere day.

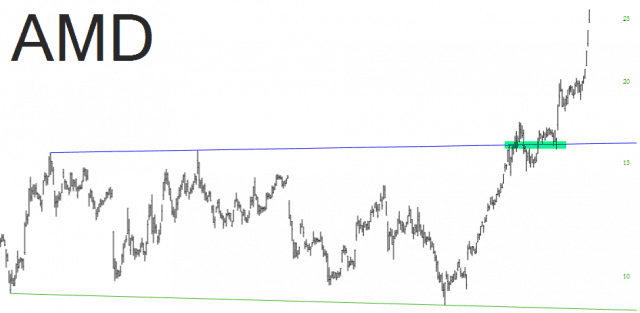

First up is Advanced Micro Devices. For many months, it looked like it was forming a reversal pattern, as it had done five prior times in its history. Instead, it broke above this pattern (green tint), tested it successfully a couple of times, and then – zoom – – a runaway stock. A moment of silence, please, for anyone who had shorted this. The Greater Fool Theory is in top gear now.

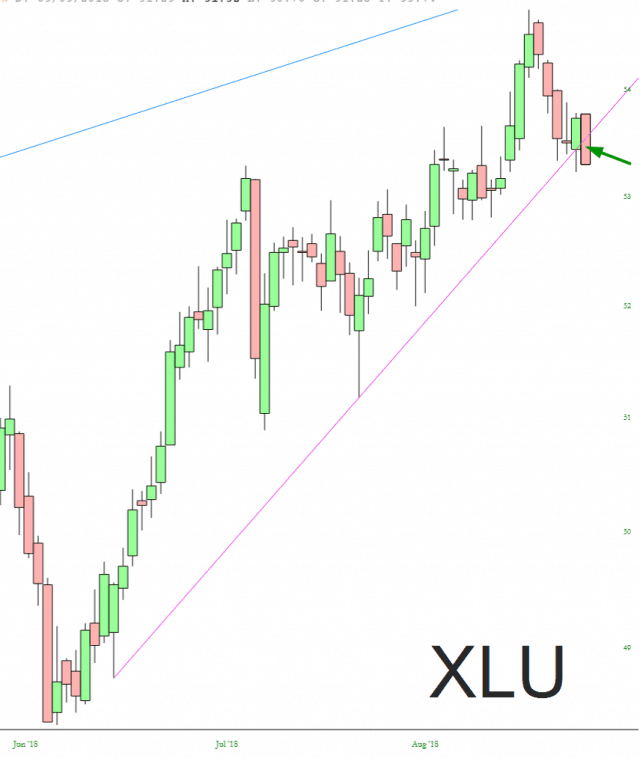

Utilities Trendline Broken

My XLU put options (January 2019 $54 strike) are doing well this morning, thanks to the continued breakdown of the Dow Utilities. It’s nothing dramatic, but – – it’s progress!

It’s not an accident that I chose such a distant expiration date. I have no intention of seriously closing this until such time as XLU is in the upper 40s.

Is The Low In For Gold Yet?

For those that follow me regularly, you will know that I have been tracking a set-up for the SPDR Gold Trust ETF (GLD), which I analyze as a proxy for the gold market. I also believe that gold can outperform the general equity market once we confirm a long-term break out has begun.

While I have gone on record as to why I do not think the GLD ETF is a wise long-term investment hold, I still use it to track the market movements. For those that have not seen my webinar about why I don’t think the GLD is a wise long-term investment, feel free to review my webinar on the matter.

Since it seems that some of you have been confused by what my perspective for 2018 has been when it comes to GLD, I would like to take a moment to outline it again so we can all be clear:

As far as my expectation for the metals, when we came into 2018, I was quite bullish the metals as they had a strong 1-2, i-ii set up to the upside. I have noted many times that if a chart that presents a long-term bullish perspective, such as metals, provides a shorter-term bullish potential set up, I will always defer to that set up as my primary expectation. That is what I did with the metals coming into 2018. But, I provided a clear guide that this will remain a strong perspective only if GLD remains over 119. I noted quite clearly that if GLD were to drop below 119, it would make me question that immediate perspective. (more…)