Last quarter, Facebook shocked the world by delivering an absolute bomb of an earnings report, causing the biggest market loss in technology stock history. That was just the beginning, though, as the stock is substantially lower than even back then. The gap sticks out like a sore thumb:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Smaller and Smaller Caps

Only a LAD

One of my gazillion shorts, Lithia Motors (symbol LAD) is accelerating its breakdown.

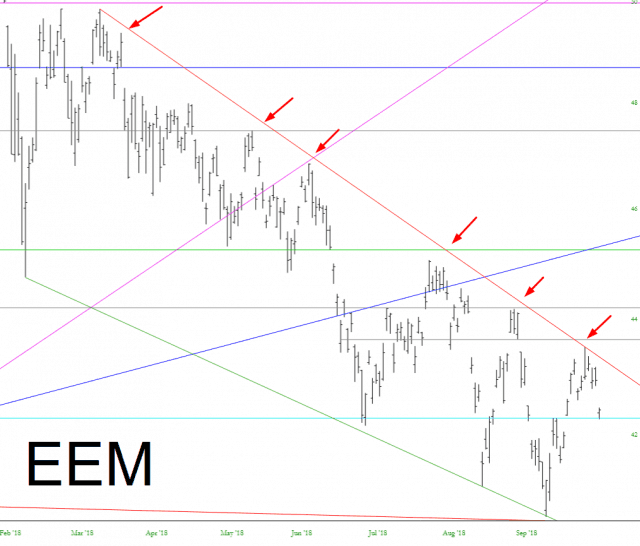

Amazing Emerging

Good for Your Health AND Your Portfolio

Hey Gang! I’ll work out some kind of a standard format for my posts soon, but I would always like to present a trade together with a plan for the stop, profit, and target.

I don’t have a ton of time so here’s the trade. Healthcare is the 2nd strongest sector determined by its bullish percent index rank (currently at 84% P&F buy signals). It’s a simple, but effective way to rank sector strength. The only stronger sector is utilities at 89% P&F buy signals. If you’re not familiar with Point & Figure charting, it’s basically a way of taking time out of the chart and displaying only the price moves. Being on a P&F buy signal means that the chart is making higher highs and higher lows.

I looked at the top 10 holdings for XLV and JNJ stood out for me as being in strong condition and a stone’s throw from its highs. It is clearly making higher highs and higher lows within an established channel and has broken a short-term downtrend line. Details are on the chart, but this trade risks approximately .50c to make $6. (more…)