This is from earlier this month, but it does a good job getting you acquainted with the man who was just recently elected to be the new President of Brazil.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Yes! Several!

Polyamory in SlopeCharts

I am extremely pleased to let you know there is another drawing tool in SlopeCharts, and it is one I’ve been eager to see for a while: the polygon tool.

This new tool is the rightmost on the drawing tools palette.

Well, I Was CLOSE!

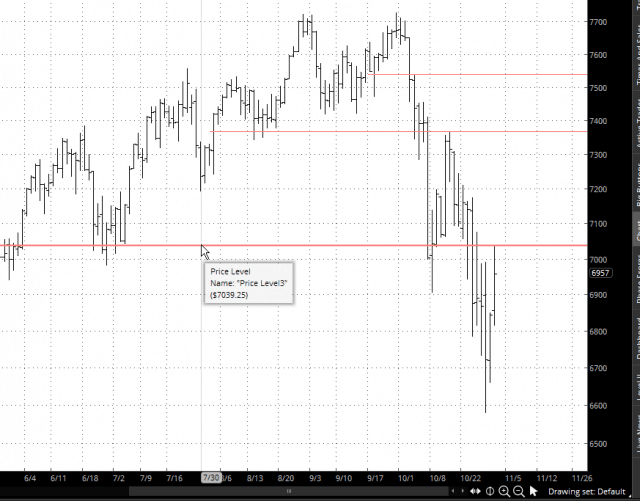

Yesterday afternoon, I declared 7000 as the ‘magic number’ for the NQ. After Facebook’s report, the NQ surged, and we actually exceeded by target by 0.5%. Surely you’ll allow me that much leeway. Suffice it to say, I was shorting like a sonofabitch in the final half hour. I’ve DOUBLED my exposure.

Just the Stats Ma’am

The close on SPX yesterday was a clear close back over the 5dma, and as it has been a decline of more than 2% since the last break down, that puts SPX back on the Three Day Rule. That means that if SPX should deliver a clear close (4/5+ handles) back below the 5dma, currently at 2684, today or tomorrow, then SPX would very likely retest the October low in the following few days.

When SPX is trending in either direction I watch the 5dma and the 50 hour MA for trend support or resistance. The 50 hour MA is currently in the 2694 area, so that and the 50dma give us the short term support area.

On the resistance side there is a possible IHS neckline in the 2725 area, and that’s still in play potentially if SPX breaks back under the 2685-95. That would have an ideal right shoulder low in the 2651/2 area, but in practical terms in the event of a daily close back under the 5dma SPX would likely deliver at least a new retracement low. (more…)