This is a cautionary tale. A tale of a fund of nearly 300 clients and nearly $80 million which blew up in the span of hours from a market move that was, in the grand scheme of things, not that big a deal. It illustrates how excessive leverage can completely torch the risk-taker (and, in this case, his clients). And it just happened.

The person in question is James Cordier, who is a bestselling author of books about options. One glance at Amazon, and you can see the myriad of volumes he’s written on the topic:

He parlayed his knowledge and media appearances into a thriving fund named, appropriately enough, OptionSellers.com which, until quite recently, had a beautifully-crafted website touting the virtues and profitability for selling options for high net worth investors. Here is what the site used to look like:

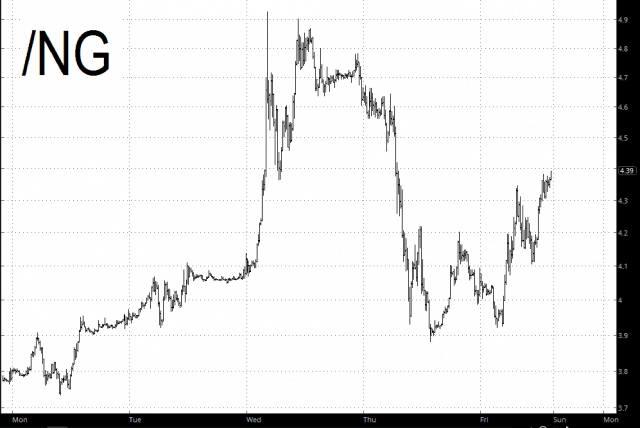

Until recently, things were sailing along smoothly for this fund. As you may have heard, however, last week was quite the roller coaster for the natural gas market. As the chart shows below, the NG market went roaring higher on Wednesday morning, plunged on Thursday, and then reestablished half its gains on Friday. I suspect 99.9% of the public neither knew nor cared about this market action, but Mr. Cordier and his investors certainly did. Or at least they do now.

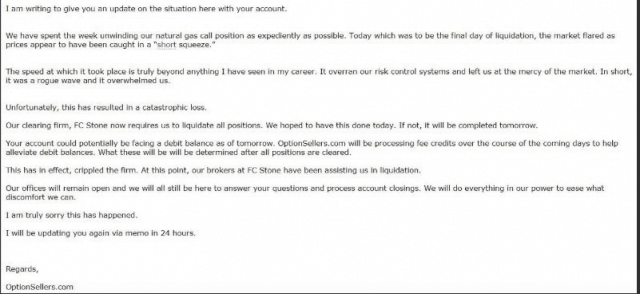

Here’s the letter he sent out…..I realize the type is small, but the key words are “catastrophic loss” and “your account could potentially be facing a debit balance.” In other words, he’s telling them that not only is the entirety of their investment wiped out, but they’re actually on the hook to the brokerage for additional funds.

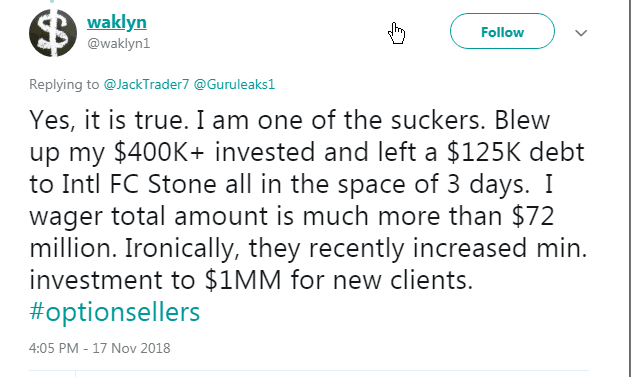

The reaction from investors was understandably swift. Here’s a tweet one of the unfortunate 290 sent:

In spite of the suddenness of all this, the social media accounts of OptionSellers have been wiped clean. Here, for instance, is what their YouTube page looks like now:

And their former fancy website has taken on a much simpler appearance:

For some reason, Mr. Cordier decided to post a tearful video on Friday (although, I’d have advised against the expensive watch and fancy cufflinks, to say nothing of the mentions of sipping wine while watching the markets). It’s pretty harrowing to watch, but if you dabble with options, you might want to watch it just to scare the holy hell out of you. In spite of the pacing and nature of the video, don’t worry: he doesn’t shoot himself at the end.

NOTE: I was surprised that the above video was posted in the first place, and in the back of my mind something told me they would take it down. Sure enough, they did, probably because their lawyers had a shit fit. Happily for my readers, however, I had the foresight to download it, so I’ve got a copy right here on my hard drive. You’re welcome.

I take no joy in seeing this train wreck. It’s clear that the firm took risks far in excess of good sense, but far smarter and better-resourced investors (Long Term Capital Management leaps to mind) have done the same. As I said at the beginning, I offer this as a cautionary tale as to just how badly you can get burned with options if you get greedy. Oh, and the lawyers for clients aren’t wasting any time, either.