With the dollar turning around as traders put “risk on” again, the bears have few opportunities. But one in gold triggered on Wednesday’s Globex close.

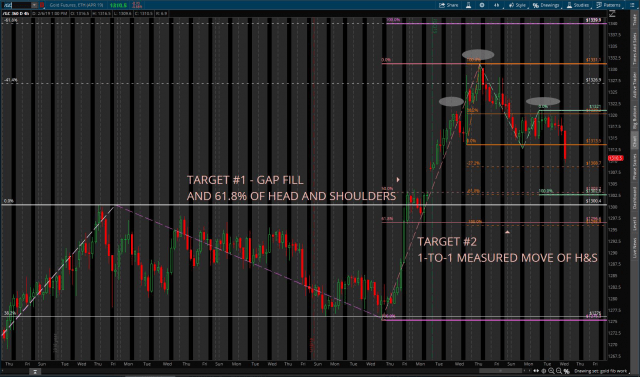

Take a look at the Head & Shoulders pattern on the gold futures’ 4-hour chart.

A nice 38.2% retracement on the right shoulder is typically a good sign for pattern completion (indicative of momentum), and the break of the neckline late Wednesday sets up a potential overnight entry with a better than 1-to-1 risk/reward scenario.

Here are the areas to watch:

1 – 1308.70-1307.80. The zone from the 1.272% extension of the pattern to the gap-up low from January 28th

This signifies a potential bear trap zone, where shorts would potentially get eaten by gold bugs… err run over by bulls.

2 – Target #1 area of 1303.20-1302.50

We find quadruple confluence within this zone.

a. 1303.20 is the 50% retracement (aka half-back) of the bull impulse move up off the 1275.30 swing low

b. 1302.60 is both the 61.8% extension of the head and shoulders pattern, AND a measured move projection of the swing down from the 1331.10 high to the 1312.70 low from the 1321 lower high

c. 1302.50 would fill the gap up from the Globex close on January 28th (NOTE this is a contract roll gap)

3 – Target #2 area of 1296.60-1295.90

This zone is the 61.8% retracement of the bull impulse up from 1275.30 to 1331.10, AND the full measured move target of the head and shoulders pattern.

Now about that risk reward for potential entries. The conservative way to trade a head and shoulders pattern is to:

- Wait for a break and close beneath the neckline

- Place a sell order at/near the neckline to get short on a retrace

- Set a stop above the right shoulder

- Set target #1 at the 61.8% extension of the pattern, with target #2 at the 100% extension

NOTE THIS IS NOT A TRADE RECOMMENDATION. ONLY ENTER TRADES THAT MEET YOUR TRADE PLAN THAT YOU CAME UP WITH, BACKTESTED, FORWARD TESTED, AND MEET YOUR OWN PERSONAL RULES

In this case, a trader could HYPOTHETICALLY set an order to short gold futures (or mini-gold futures) at or around 1313.50, and place a stop above the right should at 1321.

If target #1 is down at 1302.60, then the trade would risk HYPOTHETICALLY 75-ticks to make a potential of 109-ticks, with target #2 providing a potential profit of 176-ticks.

That’s 1.45 to 1 Reward to Risk for target #1, and 2.34 to 1 for target #2.