Since maybe Thursday’s selloff gave me permission to show some favorite short setups without embarrassment………..here goes:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Since maybe Thursday’s selloff gave me permission to show some favorite short setups without embarrassment………..here goes:

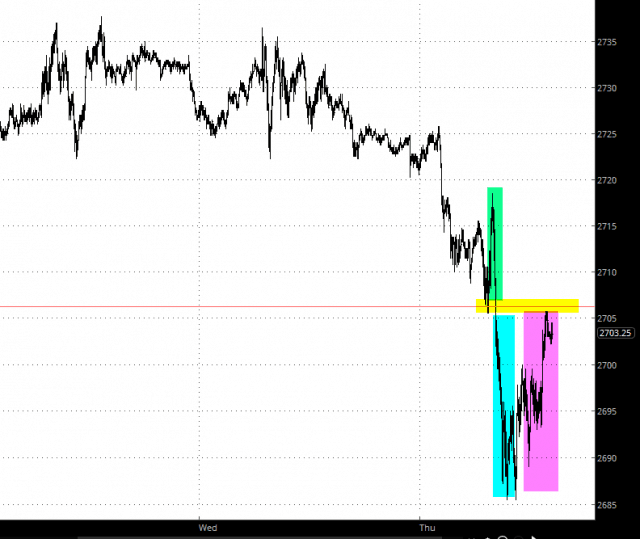

The market was all over the placed today, and I noticed on my /ES chart a horizontal line that seemed to have significance. I was so occupied today I didn’t bother trying to figure what it was while the market was open, but it bounced off it (green tint), fell hard once it slipped beneath it (cyan tint) and then went zipping back up to it right up to the close (magenta tint).

My apologies for the lack of an update last week, which was particularly busy. Today I’m going to do a multi-timeframe review of where SPX is now, and the implications longer term of this seven week uptrend having risen this far.

Just to mention, we are doing our monthly free public Chart Chat on Sunday, and if you’d like to attend, you can register for that on our February Free Webinars page. We are also starting our next four week Trader’s Boot Camp on February 18th and if you’re interested you can register for that on our Trader’s Boot Camp February page, though we do charge a modest fee for that of course.

One thing I was talking about was the importance of the monthly close in January relative to the monthly middle band. Historically this has been very important resistance after a serious bear move has started, and since 1957 every clear monthly close back above the monthly middle band at this stage has always delivered a retest of the all time high before any serious lower lows were made. We saw that clear monthly close back above that monthly middle band at the end of January. That high retest has sometimes made the second high of a large double top of course, although on many occasions that has been the start of a new leg up. (more…)

Well, it shouldn’t come as a surprise, I suppose, but it turns out the cocaine addict below – – who has been ceaseless with assurances at how peachy, super-duper, and scrumptious the trade talks have been going, finally admitted that Xi and Trump aren’t even going to meet.