Part of City Office REIT’s Mission City Campus Property In San Diego. Photo via Google Street View.

Another Way Of Looking At City Office REIT

Divergent opinions make markets, and City Office REIT (CIO) has elicited divergent opinions on the web. On the bullish side, Brad Thomas, argued that City Office was poised to profit, based on its history of acquisitions, its leverage, and its management acumen. Thomas concluded that City Office was a “strong buy”, though he warned of the risks inherent in a small cap REIT.

On the bearish side, pseudonymous blogger “Beyond Saving” warned of danger ahead for City Office, based on short lease terms, “extreme” leverage, “flawed metrics”, and a dividend not covered by its cash flow. On that last point, Beyond Saving echoed Jussi Askola’s warning last fall that City Office was a “sucker yield”.

Given the divergence of opinions here, I thought it would be interesting to see what options market sentiment says about City Office. Currently, it leans toward the bearish side, going by the gauge Portfolio Armor uses, as I elaborate below. First, a quick explanation of why and how we gauge options market sentiment.

Gauging Options Market Sentiment

The reason we started gauging options market sentiment was to screen out “false positives” from our screen based on total returns. When pulling up securities with the best total returns, many of the top names were ones that had recently been acquired for a large premium. Their past total returns were a “false positive” in the sense that they didn’t predict future strong returns, because the stocks would typically trade within a few cents of their acquisition price until the deal closed.

These stocks tended to be cheap to hedge against single-digit declines with optimal, or least expensive, put options, because options market participants didn’t expect their prices to drop (because they were about to be acquired for a slightly higher price). But at the same time, optimal collars were usually unavailable for them, because there were few, if any, bids on calls with strike prices above the announced acquisition price.

This screen, attempting to find an optimal collar for securities when hedging against a greater-than-9% decline over the next several months, became one of our two screens for avoiding bad investments, as we found that securities that failed the screen tended to do worse than ones that passed it.

Applying This Screen To City Office

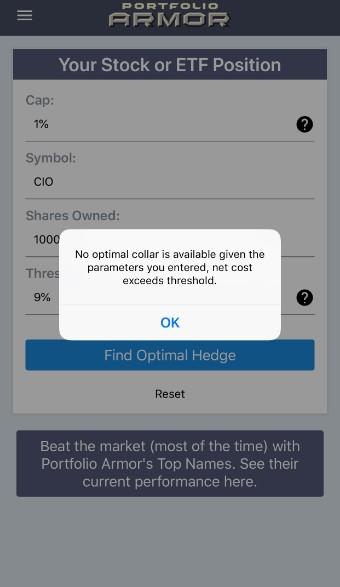

If you attempted to scan for an optimal collar to protect against a >9% decline for City Office over the next several months as of Monday’s close, using the Portfolio Armor iPhone app, you would have gotten the error message below.

The reason you would have gotten that error message wasn’t because there were no bids on calls with strike prices more than 1% above CIO’s current market price but because the potential income generated by those bids was too low to offset enough of the cost of the put leg required for the downside protection.

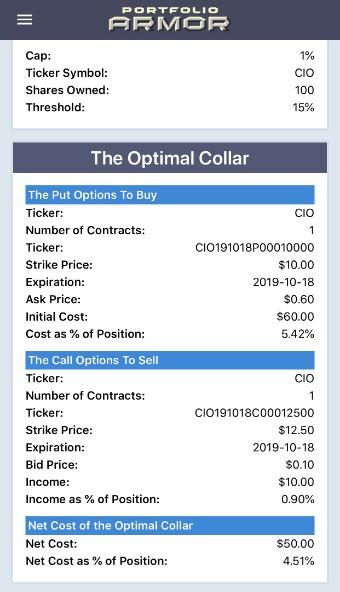

It was possible to find an optimal collar for CIO if you tried to protect against a >15% decline instead, as you can see below.

Note: the cost of buying the put leg above (calculated conservatively, at the ask) was six times the income generated by the short call leg (calculated conservatively, at the bid). That suggests that options market participants are more bearish than bullish about where City Office’s share price will be in October.

Wrapping Up

The screen above is based on what New Yorker columnist James Surowiecki termed the wisdom of crowds:

Large groups of people are “smarter” than an elite few, no matter how brilliant — better at solving problems, fostering innovation, coming to wise decisions, even predicting the future.

The large group of people in this case is the options market. It’s possible that that group may not be right about City Office this time, but if you’re on the fence about the REIT, it may be worth heading its wisdom.