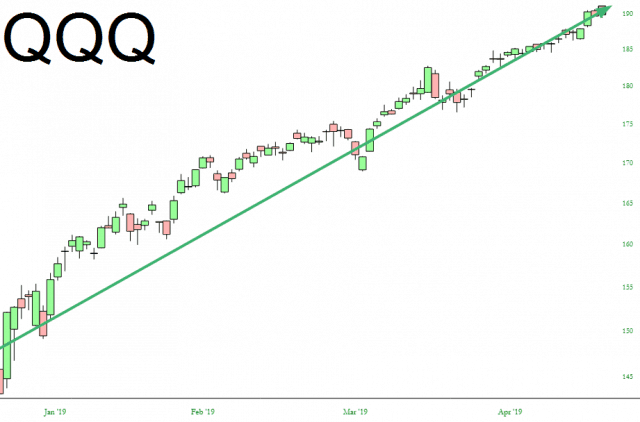

99.99999999% of the public wants this fake, fraudulent, Treasury Department-fueled NASDAQ rally to continue until the $NDX reaches a million points.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

99.99999999% of the public wants this fake, fraudulent, Treasury Department-fueled NASDAQ rally to continue until the $NDX reaches a million points.

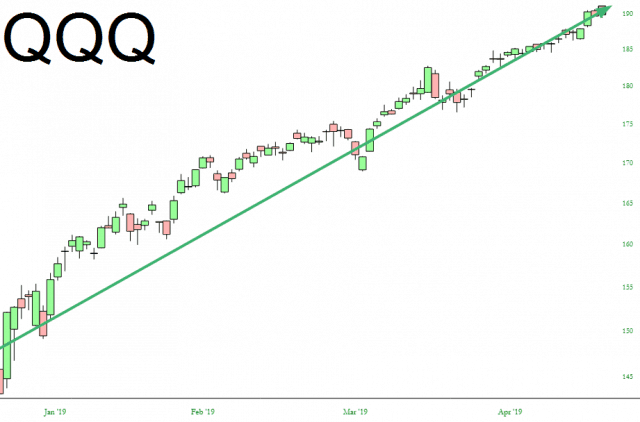

Now that Netflix’s earnings are well behind us, it is relatively safe to take a look at it as a potential short. To my eyes, the most significant technical feature is the price gap which I have highlighted in two ways below. A trader short this stock would, I think, be wise to have a stop-loss set just above that level.

These three health and technology stocks are seeing technical strength ahead of upcoming earnings.

Evolus, Inc. (EOLS) gained 50 cents to $26.44 on 537,100 shares Wednesday. The performance beauty company said it will release earnings after the close on April 30. The stock is right on the verge of taking out the declining tops line of its nearly 3-month consolidation that followed its big surge in January and early February. A move through the March 19 high near $28 could take the stock to next lateral resistance at $30.

Extreme Networks, Inc. (EXTR) rose 29 cents to $8.26 on 2.1 million shares Wednesday, nearly 1 1/2 times its average volume. The software-driven networking company will announce earnings before market open on May 1. The move popped the stock out of a nearly 2-month resistance line and mini base. Watch for a test of next resistance at $8.75 just above the February high.

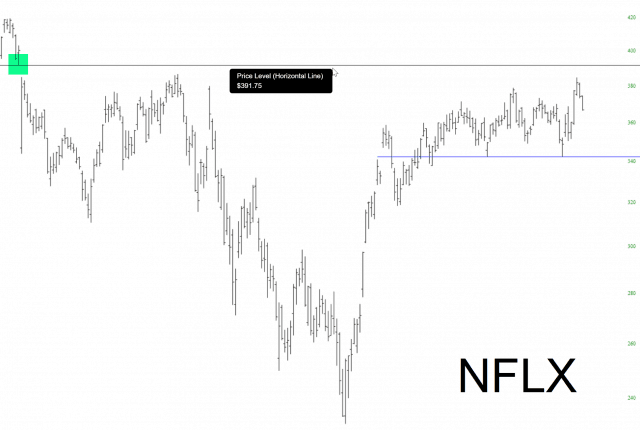

The ETF for the consumer discretionary sector broke its trendline ages ago, but as of yesterday, it perfectly tagged the underside of the now-broken trendline and should treat it as resistance henceforth.

The risks of chasing hot stocks can be illustrated with this morning’s Exhibit A, which is Xilinx. This is one of those company which I have no idea what it does, but it has a name like a Hollywood film would give to some made-up Silicon Valley corporation as a villain. Anyway: