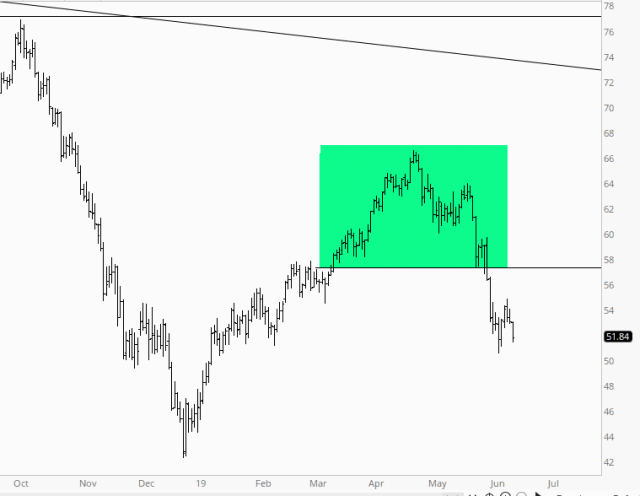

The quotes are pleasantly red this morning – -ES down, NQ down, YM down – but one in particular is getting zapped particularly hard, and that is CL, crude oil, which is down nearly 3%. The /CL contract shows that, after a modest reversal pattern (tinted) oil has been steadily weakening.

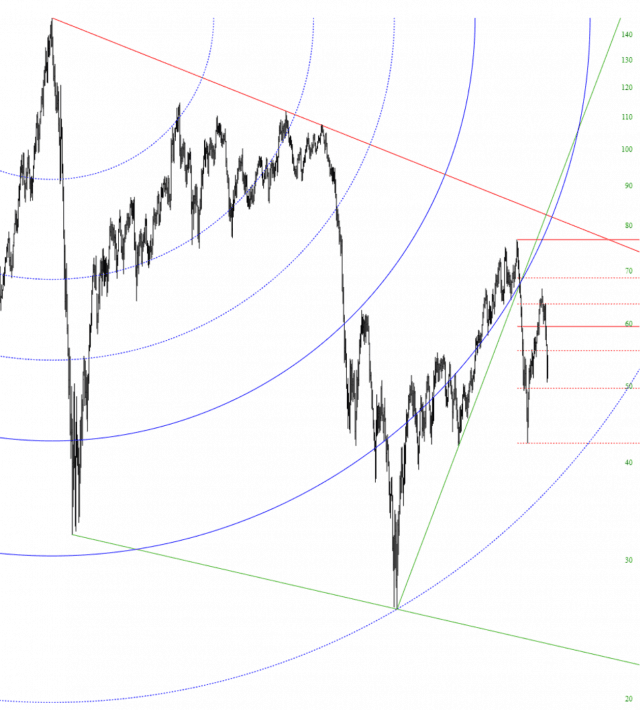

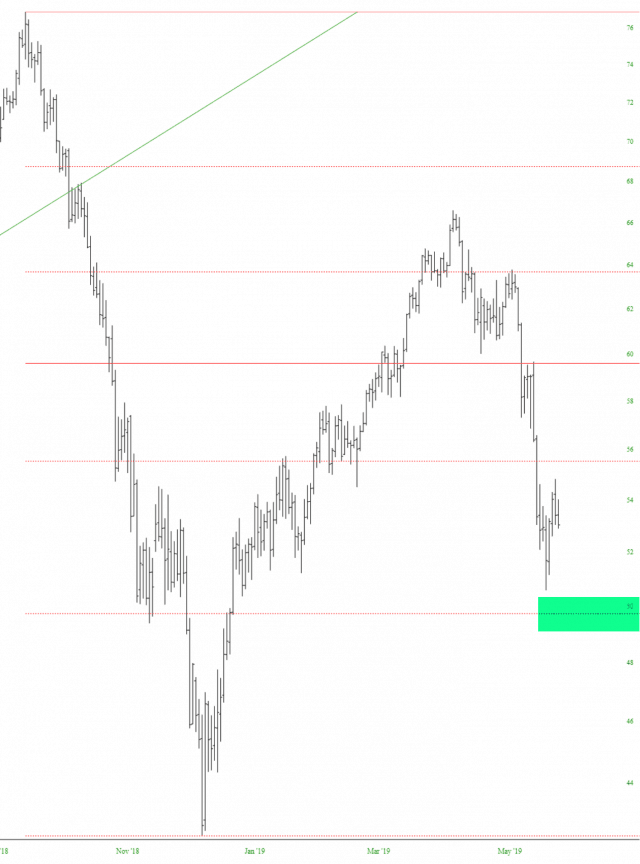

Looking at the very long-term oil, augmented with Fibonacci arcs and a Fibonacci retracement, gives us more perspective. Although you would never guess it looking at the gas bumps here in the Bay Area (where gas is still above $4/gallon), oil has been broadly weak for many years.

I suspect the next level of support for crude will be around $50, both because this is the next Fibonacci retracement level but also becomes humans are weirdly hung-up on Big Round Numbers.

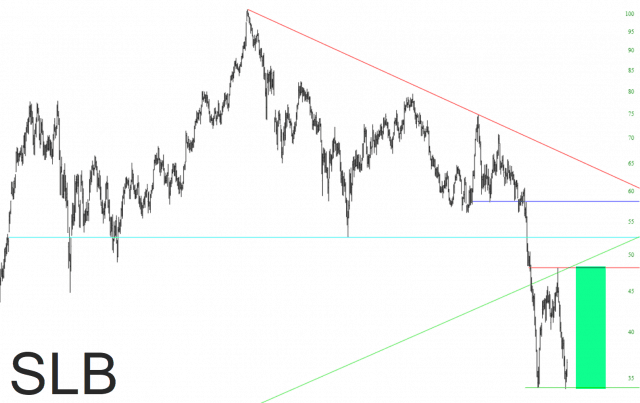

Should oil find some strength there, some energy companies offer an opportunity for a strong bounce. Schlumberger, for example, is right near the bottom of a well-defined range.

As for my portfolio in general, I’m more aggressively positioned than I’ve been in over a week, with 57 short positions and a 184% commitment level.