In case any of you missed my long post about the Modern Monetary Theory, please read it here. I rarely get so much positive feedback on a post, and I think you’ll learn something from it, and maybe even enjoy the read.

I had an excellent trading day. I remain entirely short and completely out of buying power. The bears do not have this market by the tail, but we’re making progress. Below I present, in three groups, some important ETFs and cash indexes. I have grouped them based on whether or not they have completed their topping patterns, have not, or if they are close.

One last point: I am getting a lot of emails from subscribers who are making great profits based on Slope, and they have been kind enough to show their gratitude. If you benefit from Slope and the hard work I put into making this site better every day of the year, please consider at least a Bronze membership. Every premium membership gets great privileges, and, because this is my livelihood, I would be grateful for your patronage, particularly if I have been of aid to your own trading. Here is the membership page.

Unbroken

These charts, which represent a substantial part of the market, remain range-bound. For the entirety of August, the market has been banging between highs (based on silly rumors and tall tales) and lows (based on the creeping reality that we’re all doomed). However, every one of these support levels have held. Once we “escape” from this range, the move is going to be extraordinary, particularly if the escape is to the downside.

Close

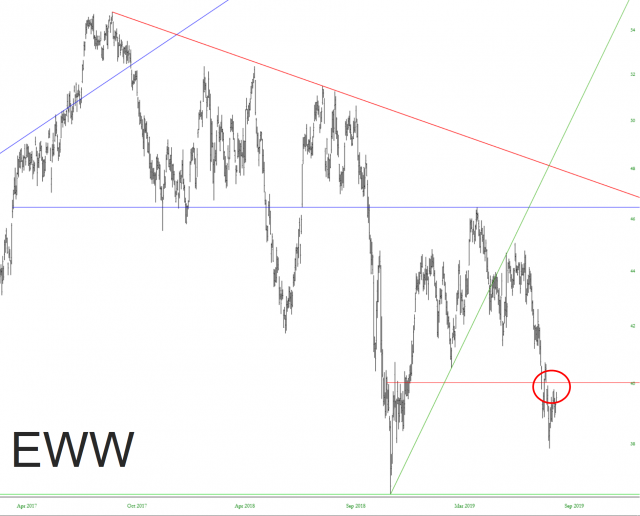

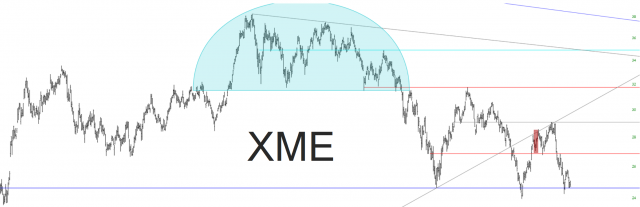

These two are “close, but no cigar”. They absolutely deserve diligent observation.

Broken

Lastly, these charts are done and ready to fall. Some are more broken than others. Banks, for example, just barely broke support today, whereas Mexico is absolutely done with its pattern.