Before I begin with what I want to say this weekend, let’s just stop and take a look and marvel at what we’ve just seen. For the next hundred years, students of the stock market will look back at the last three weeks and attempt to understand and learn from what we just experienced. A three week 27% crash in the S&P 500 straight off of all time highs. The Russell fell 35%. Amazing.

It is highly likely you will never see another crash quite like it again in in your lifetime. It is important to accurately process and accept that reality. If you profited greatly from it, congratulations. If you survived it, congratulations.

A bounce started on Friday. In this article I’m not going to tell you how high this bounce will go. I’m not going to tell you what’s going to happen in the weeks and months ahead. I’m not going to tell you we’re going back to all time highs. I’m not going to tell you we’ll see new lows after this bounce ends. What I am going to give you is a tool to trade this bounce with to attempt to maximize its potential, and limit your risk of shorting the market again too soon.

Before I do, let’s take a look back at the recent history of the stock market. In April of 2013 the SPX had climbed above the 2007 highs, and was launching to new highs. It continued moving higher in a tight channel, riding the 50 week moving average into the fall of 2014. As we entered the volatile September/October period of 2014, I became convinced that we were getting ready to start a serious decline. As we entered into September, SPX made a slightly higher high than July, and then saw a failed breakout. I got aggressively short.

What followed was the “Ebola Panic” of 2014. SPX swiftly declined 10% over the course of about a month. Sound familiar? Here’s how it looked.

I profited greatly from the “Ebola Crash”. Imagine how it felt to correctly call a top in SPX, then ride it down, showing a triple digit profit in your trading account. Take a good look at that chart. Imagine the panic of those volatile few weeks. Then imagine how it felt to be profiting greatly while the world was losing money. Was the QE bull market over? When should I short again? What happened next?

Here’s what happened next.

What followed was a long lasting short term uptrend that set records with its duration. How did I handle it? I attempted to short into that uptrend numerous times along the way, convinced that more downside was coming. I ended up losing nearly all of the profits I had made during the selloff.

This experience gave rise to what I call ATR Reversal Levels. I will detail how to construct and use these reversal levels in the video below. I used these reversal levels in my trading for over a year after 2014, and found mixed success. Over the course of that year I back tested this trading technique to 2007 to better understand how it operated under all market conditions. What I found was that on average the technique yielded more winning trades than losing trades, but on average it did not yield the kind of trading performance I wanted. However, what I did find was that where this indicator excelled was during event-driven panic selloffs and the bounce that followed. This is where we find ourselves today.

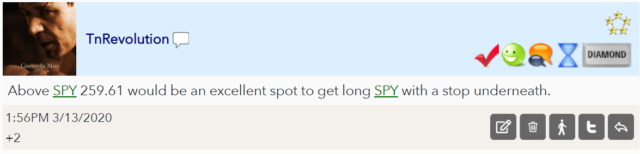

Late in the afternoon on Friday I posted this comment on Slope of Hope. How did I establish such a specific price level that led to the ignition of a powerful rally, and why do I think a bounce is beginning?

In the below video I will discuss how to construct and utilize ATR reversal levels. Let’s take a look.