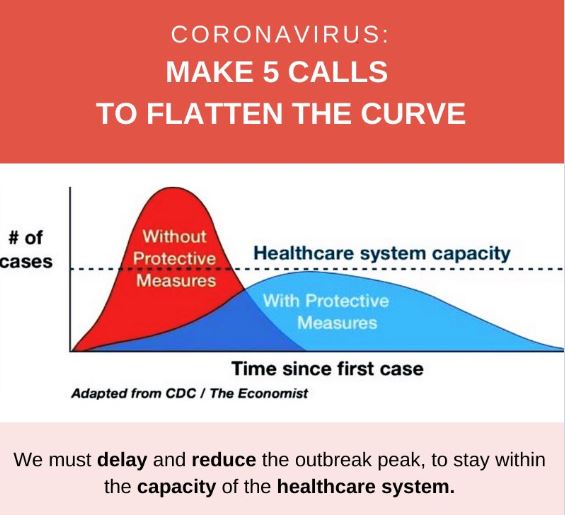

Fellow Slopers: My Twitter correspondent Claire Lehmann shares a strategy for beating the COVID-19 coronavirus: essentially social distancing to flatten the curve as shown above. You’ve probably seen a similar graphic, but I am passing it along in the event you haven’t.

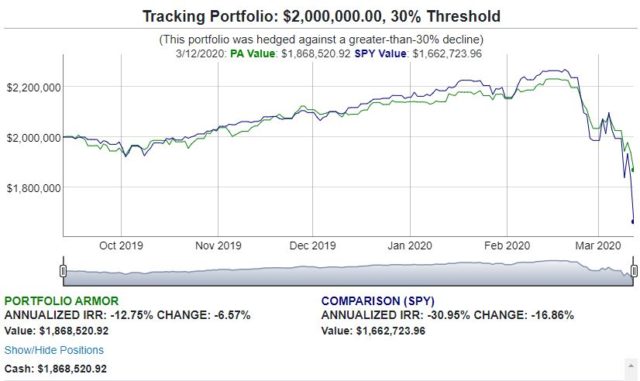

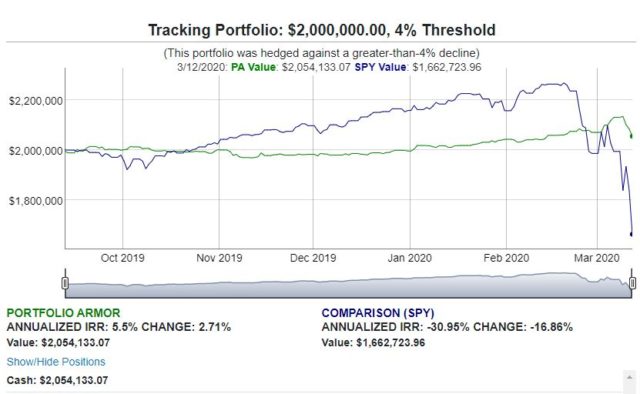

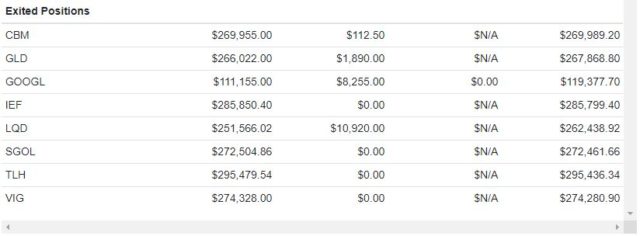

As far as portfolios surviving COVID-19, Portfolio Armor had a number of 6-month tracking portfolios created on September 12th which wrapped up on the worst day in the markets since the 1987 crash, March 12th, 2020. You can see how all of the September 12th, 2019 tracking portfolios did here, so I’ll just highlight the performance of two of them below.

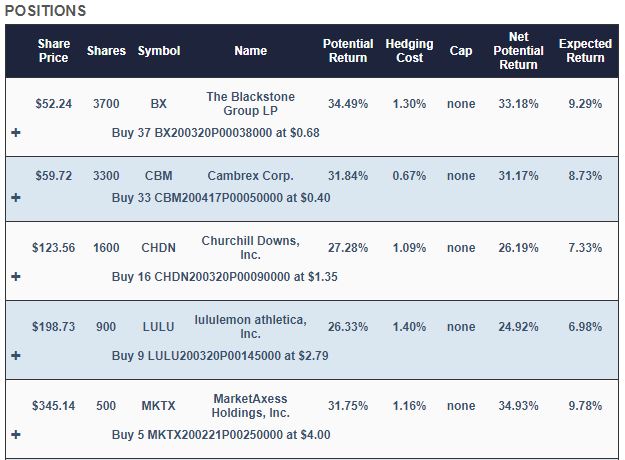

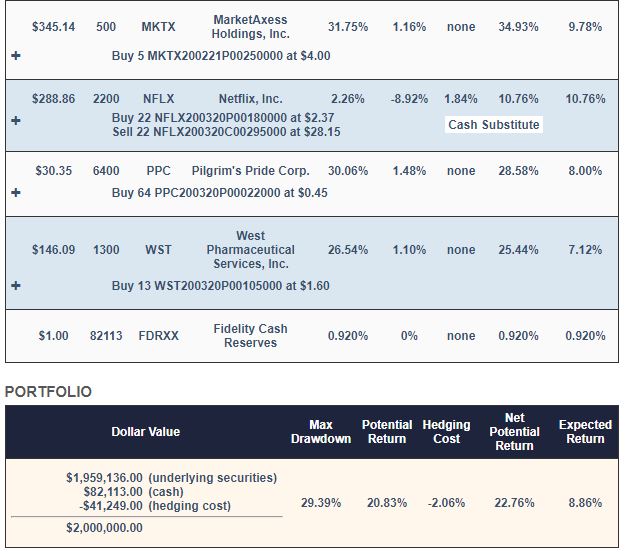

Aggressive Portfolio

This portfolio was hedged against a >30% by March 12th.

And this was its performance as of Thursday’s close, net of hedging and trading costs: down 6.57% versus the S&P 500 index-tracking ETF SPY, which was down 16.57% over the same period.

Conservative Portfolio

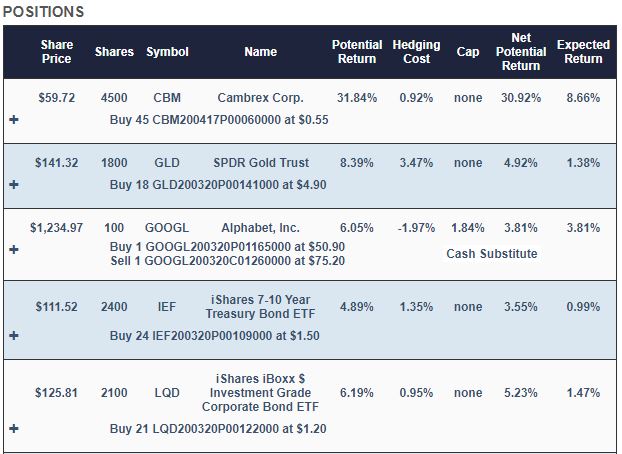

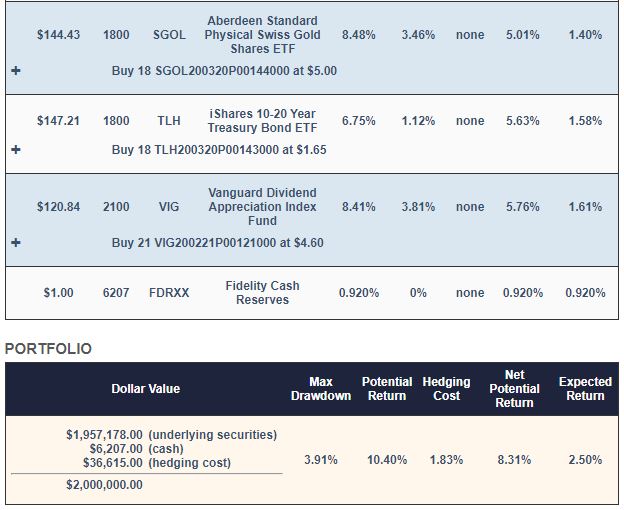

This portfolio was hedged against a >4% decline. You’ll notice some different holdings in this one, as the universe of securities hedgeable against >4% declines in September was a lot smaller than the universe of ones hedgeable against >30% declines.

And this was its performance as of Thursday’s close: up 2.71%.

Wrapping Up

It’s good to know that the hedged portfolio approach I’ve shared on Slope in the past has performed well during the most extreme market conditions. Stay safe, everyone.