We’ve had about 18 months of trading activity compressed into a month. It was precisely thirty days ago that the market was at its highest level in human history. As of today, the Russell 2000 was at the same level it was in the year 2014. Six years of gains destroyed in thirty days. Amazing.

I started to wonder: “When did Slopers start to sit up and take notice about this virus?” It’s a little difficult. See, the past ten years, there have probably been twenty to thirty “big deals’ (especially if you read ZH) that turned out to be absolutely nothing. So I suspect when people started talking about this strange new disease from China, a lot of us gave it scant attention.

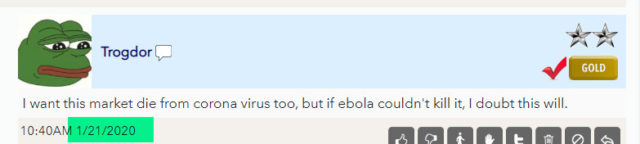

I poked around a little bit, and it looks like the first reference to “corona” was back on January 21st:

Well, that wish came true. The market did indeed die! Notice the Ebola reference. That was one of the “big deals” I mentioned which turned out to be irrelevant to breaking the market. It took Covid-19 to do the deed.

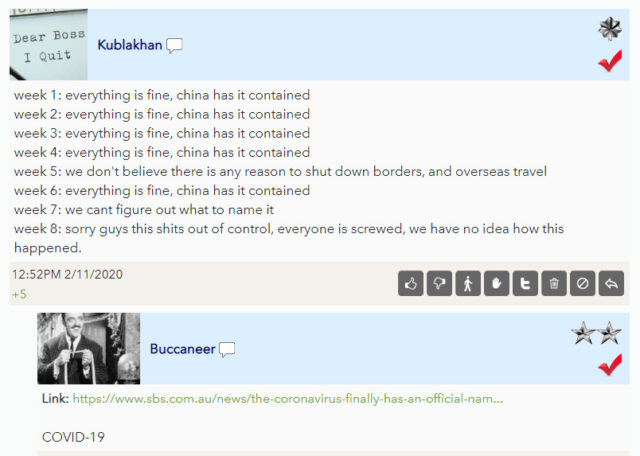

And how about the term “Covid-19” itself? Well, here on Slope we were introduced to it on the very day which it was christened with its name:

As you can see with the remark above the “naming” post, the conversation about China and the chatter surrounding this disease was starting to pick up steam. The above exchange was on the 11th of February, just over a week before we began rolling over.

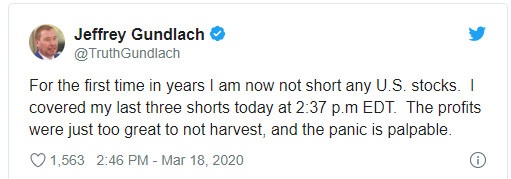

And now, nearly 11,000 Dow points later, I am hoping we are done with the selling and have a big, fat bounce in store. I’ve already stated my portfolio positions (which though “short” are still equity-bullish). And I’m pleased to see an investor far greater than myself appears to be of the same mindset: