An Inauspicious Top Name

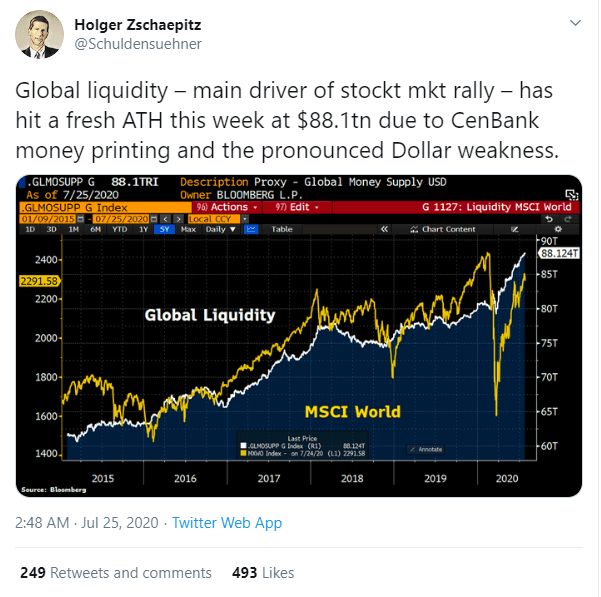

I included the tweet pictured nearby, by Holger Zschäpitz, in my previous post (“Letting The Fed Be Your Friend“). The gist of that one was that the flood of dollar-weakening liquidity was bullish for precious metals names, so it was unsurprising that four of them appeared on Portfolio Armor‘s top ten names as of Friday’s close.

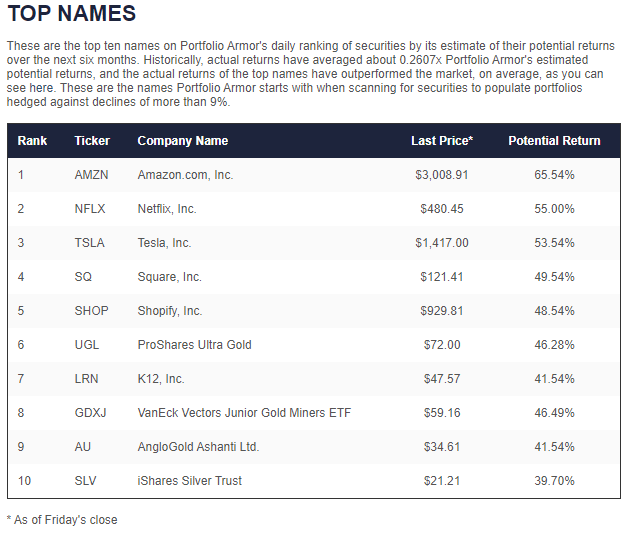

Precious metals names UGL, GDXJ, AU, and SLV all appeared among our top ten names on Friday.

Gold hit new highs on Monday, which was consistent with that. What wasn’t consistent with that was one of the names that appeared on our top names list on Monday, the Direxion Daily 30-Year Treasury Bull 3x Shares ETF (TMF). That it appeared among our top ten names on Monday was inauspicious. To see why, consider how we select these.

Using Options Market Sentiment To Pick Top Names

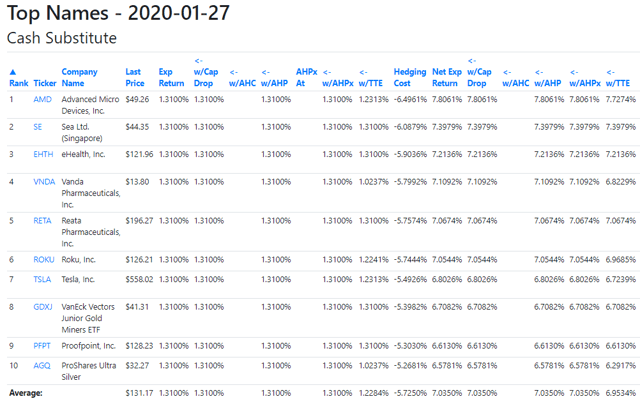

One of the main components we use to select our top names is a particular gauge of options market sentiment. Basically, our system is looking at which stocks and ETFs options market participants are most bullish on over the next six months. For example, six months ago, these were the names that gauge told us options traders were most bullish on:

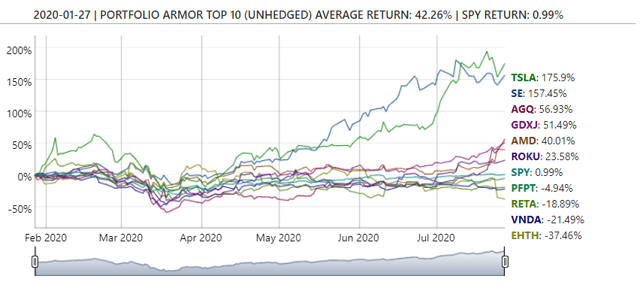

And here’s how those names performed over the next six months:

Given that recent performance, we’ve been paying closer attention to this signal.

Our Top Ten Names From Monday

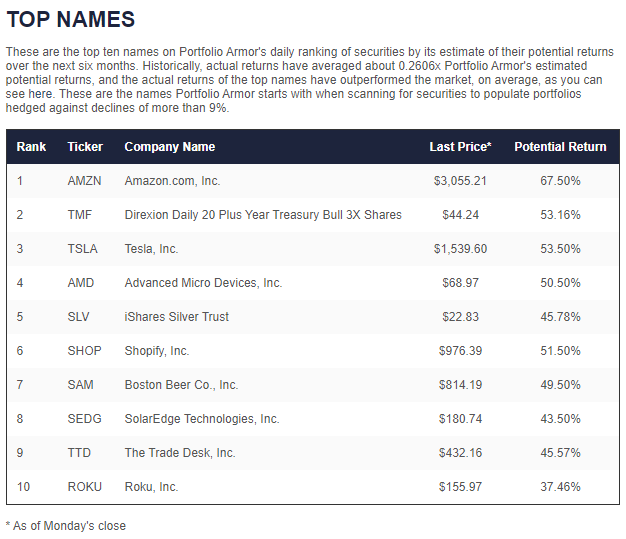

These were our top names as of Monday’s close.

As you can see, TMF was our #2 name, slotted between Amazon and Tesla. Only one of the precious metals names, SLV, remained on the list from Friday.

Why TMF Appearing There Is Inauspicious

Precious Metals names appearing in our top ten suggests options market participants are betting on a continued expansion of Fed liquidity leading to a weaker dollar. All else equal, that would be bearish for Treasuries. So why are options traders betting on TMF spiking higher? My guess is they’re buying it as a hedge against another market crash happening over the next six months. Recall how TMF did when SPY tanked earlier this year.

Betting on TMF going higher appears to be their way of taking Taleb’s Tail Risk Hedging Advice.