Short selling has been around for centuries. Dutch traders were shorting tulips at the peak of the Tulip Mania during the 1630s. But short selling stocks these days has become far more complicated. For one, the stock market has typically gone up in the long-run. Regulators also tend to step in to restrict short selling in one way or the other, especially during a crisis. But some activist short sellers have generated stellar returns on their campaigns. Here we take a look at the activist short sellers with the highest average campaign returns between 2013 and 2020.

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Buyers Cellar

The most eagerly-anticipated earnings on Wednesday afternoon was Tesla. As I’m typing this, it’s up nearly 6%, but as big a move as that it, the post-earnings change is absolutely puny compared to what options buyers were paying for. The price cone shows how enormous the expected move was.

The Rule of Law

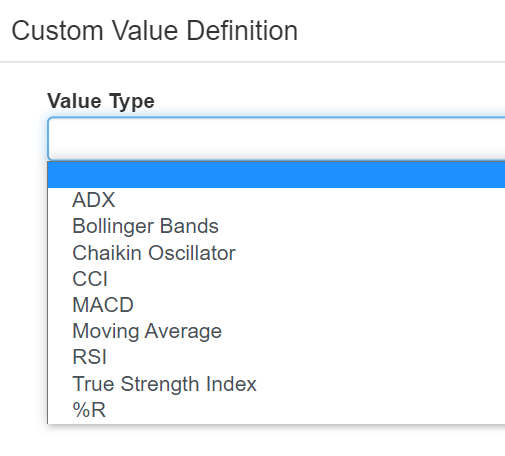

Good news for your SlopeRules users, both present and future: we’ve added a bevy of new rule types, as you can see here:

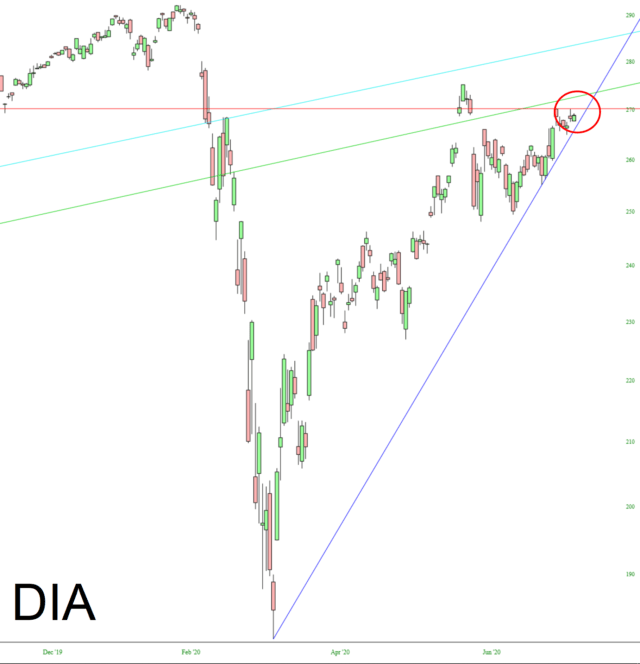

Wedged

We have genuinely reached a decision point, represented by the intersection of they key trendlines I’ve drawn.