The most eagerly-anticipated earnings on Wednesday afternoon was Tesla. As I’m typing this, it’s up nearly 6%, but as big a move as that it, the post-earnings change is absolutely puny compared to what options buyers were paying for. The price cone shows how enormous the expected move was.

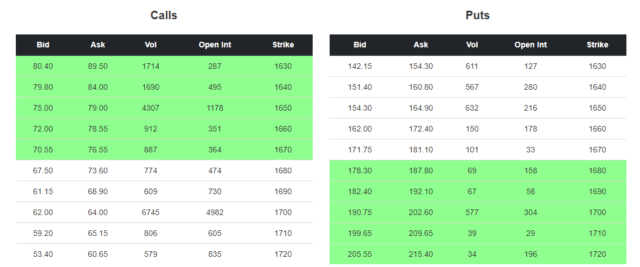

After hours, the stock is trading at around $1680 per share. Let’s look at the weekly calls and puts around that level. Suffice it to say, both bulls and bears will get squished, because the value of all of these options is about to collapse.

The volume on these things is huge – – keep in mind, these suckers expire on Friday, people! So the huge winners here, to the tune of hundreds of millions of dollars, are the option sellers.

Let’s just take a single example – – – the $2,000 call (whose price will be approximately $nothing when we re-open):

If my math is right, that’s nearly $14 million in premium right into the pockets of the options sellers for just one single strike in one single expiration period on one side (the calls). Nice work if you can get it!