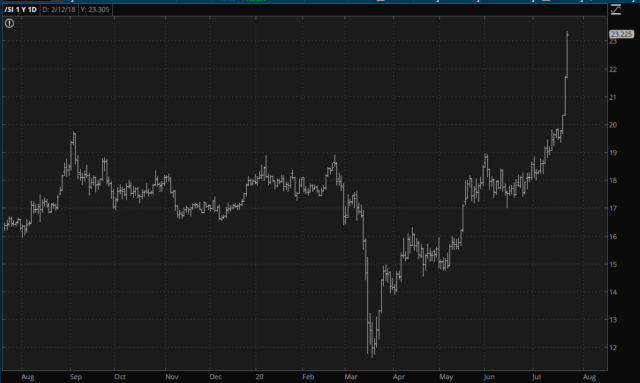

I suspect most of you have been applauding the rise of precious metals lately, particularly the explosive increase in silver’s value:

My philosophy is unchanged: the ascent in the value of precious metals (which I think is only getting started) is a repudiation of central banker insanity. I’m known as a bear, but when it comes to metals, I stand up on my folding chair, clap my hands together lustily, and shout “huzzah!” for gold and silver. I’m a bullion bull.

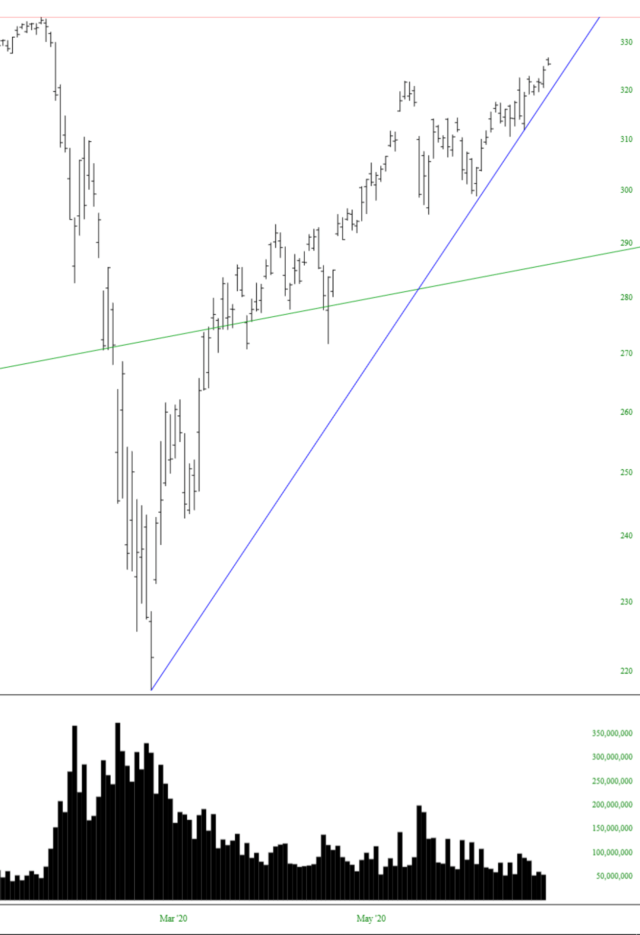

One other angle to this is contrasting the utterly phony and contrived ascent in equity prices by way of volume. Take a look at SPY, by far the largest and most important ETF proxy of the market as a whole. Look at volume. During the (justly-deserved) collapse, volume exploded higher. And what’s it doing now? Just farting along, gasping for air, requiring nothing but the endless bid from that clueless son of a bitch Powell to inch it higher every goddamned day.

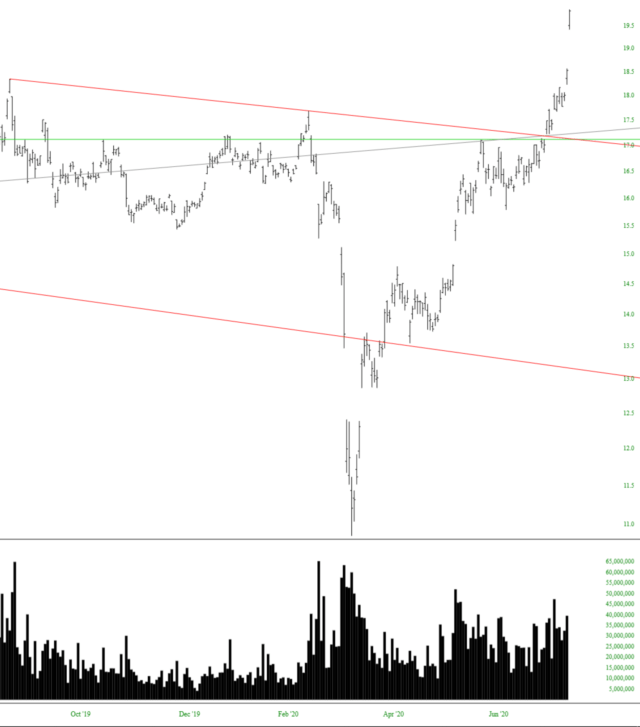

Let’s take a look at SLV’s volume. Yes, it was strong during late Feb/early March as well, but how about since then? Powerful. Resolute. Persistent. And why? Because, very slowly, people are waking up to the fact that these traitorous central banking scumbags have sold the entirety of humanity up the river, and the only hope for salvation for anyone is to possess something of value they can actually hold in their own two hands.

Death to Powell. Death to Yellen. Death to Bernanke. Long live precious metals!