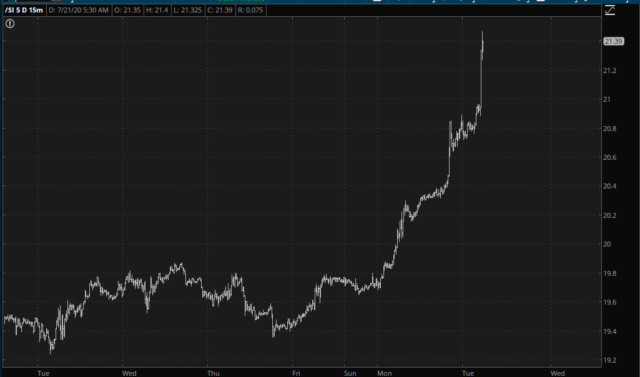

I’ve said it countless times, but I’ll say it again – – the only asset I can cheer on from an economic, chart-based, and – – dare I say it? – – moral standpoint, is precious metals. I am an enthusiastic bull, and what a delight it is to see silver soaring………

Here is a somewhat longer-term perspective of silver,which has just about doubled from the March bottom. Fantastic!

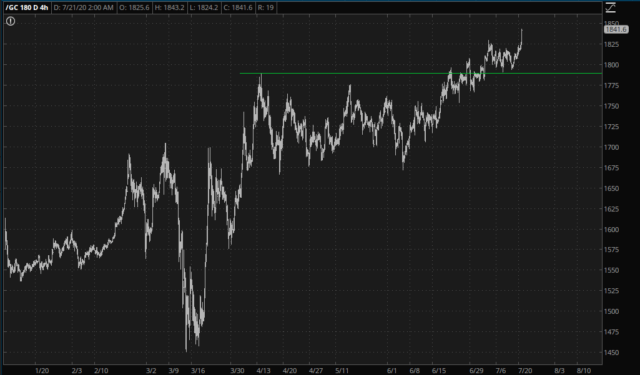

Although gold’s percentage move isn’t as extraordinary, it is pleasing nonetheless. I can’t remember the last time I’ve woken up to gold actually being up more than equities.

Taking a step way back, to weekly bars, we can see how gold has been muscling its way loftier, preparing to slug the central bankers of the world right across their collective jaw.

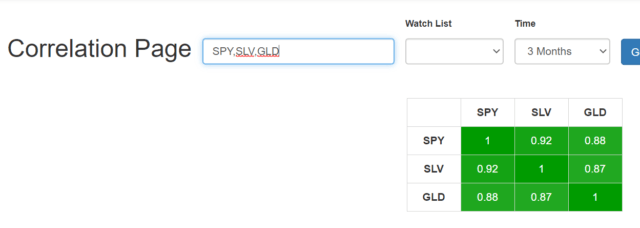

I truly have just one concern: asset correlation. Thanks to the wonderful Slope Correlation Page, I can see that, long-term, silver is somewhat inversely correlated to equities, and gold, albeit positively correlated, is certainly not joined at the hip to the S&P.

Recently, however, gold and silver are moving lockstep with equities. This troubles me, because the basis for my enthusiasm behind gold is not that Stonks Only Go Up (to borrow an idiot phrase, and yes, that’s how they spell it), but that metals are going to reveal the massive lie that central bankers have been hurling at us. In other words, I don’t want gold to sink simply because equities sink.

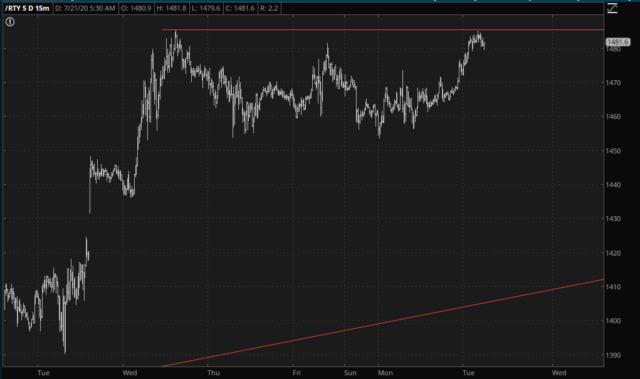

Cheered though I am with precious metals, let’s direct some nauseous attention to equities, which once again are ripping higher thanks to (what else?) another massive stimulus package. Yep, another a trillion more “dollars” from Europe is working its magic this morning. Suffice it to say, I am cheering for gold and booing at stocks.