Mornin’, everyone.

It’s another pitch-black pre-dawn here in bucolic Palo Alto. We find ourselves at the end of yet another trading week, with the indexes, by and large, spoon-feeding the bulls, as codified by Dual Mandate. Yet hope springs eternal, particularly here in the hallowed halls of Slope.

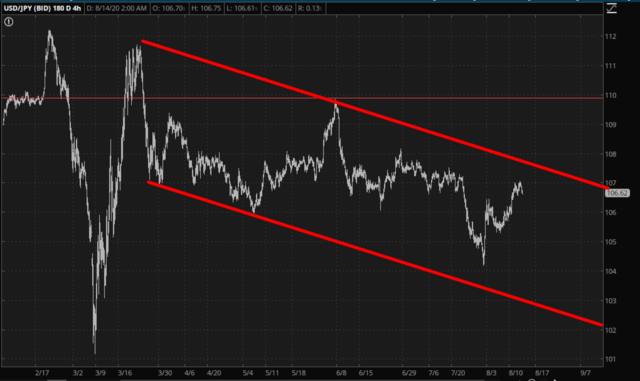

The first thing I’d note is that the US dollar continues to grind its way lower against the Yen. Oddly, the prospects of an island-nation of senior citizens apparently beats the pants off our once-great Republic. The move is slow, but seems resolute. I believe this will be important.

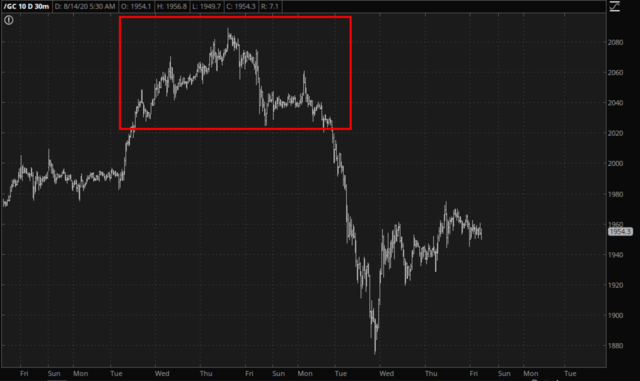

In particular, if the dollar continues to work its way toward single-ply generic toilet paper (packaging: black sans serif font on a yellow background) it should do good things for gold. It isn’t at the moment. Gold continues to have the queer characteristic of thinking it is the S&P 500, more or less. It showed signs of breaking free yesterday. I wish it luck. It would be nice to see gold get a mind of its own. Its important price level to beat is, fittingly, 2020.

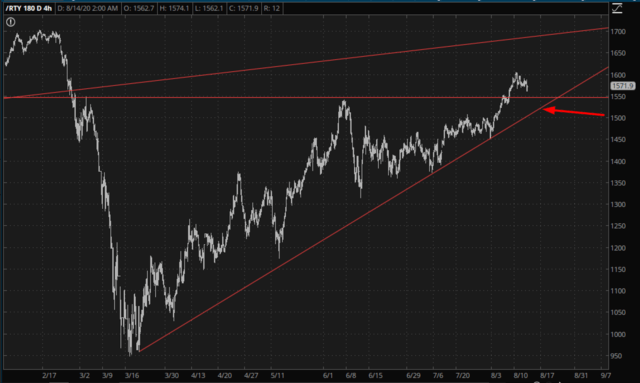

The Russell 2000, my obsession for many weeks (in spite of the “Slope of Gold” moniker that keeps getting bandied about), is unbroken. What would be needed to change that would be a failure of the ascending trendline anchored back to mid-March. Taking out 1560 would be an important first step,

As for the Timster, my interest in trading has been repackaged as understandable insouciance, bordering on dereliction of duty, but I started getting more aggressive yesterday. I’m back up to 57 short positions with a 144% commitment level.

I will say, in passing, how excited I am about the progress we’re making with Trading-On-Slope. Once we’re done, it’s going to be a delight.