My recent obsession with precious metals has been getting some ribbing, but that’s OK. I think there’s no market more important to spelling out our financial future, and as I’ve said repeatedly, it’s the one asset whose ascent I applaud.

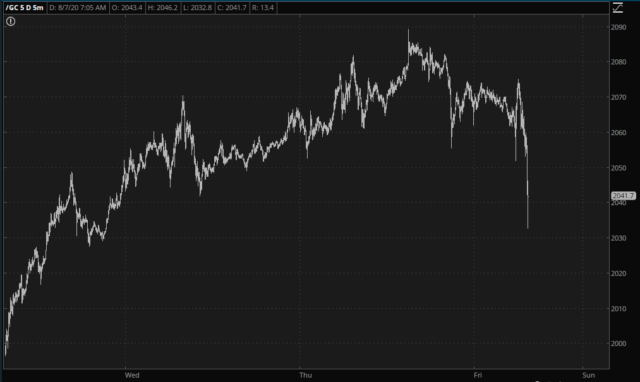

Paradoxically, I am quite pleased to see gold finally start to take a tumble.

It got very close to $2090/ounce and then did an about-face. I would say the first level of meaningful support is around $1980, and a much, much more solid level of support is way down around $1800.

Perhaps my lifelong fixation on being different from the crowd made me uneasy supporting an asset which had been garnering so much attention, but honestly, in spite of my long-term target of $6,400/ounce, there need to be shake-outs and breathers along the way.

The old “Tim’s visits to the bullion shop fade indicator” doesn’t work anymore. I’ve actually been doing quite well with my buys and sells. I sold some of my gold recently since I just had too damned much of the stuff, and I would be absolutely delighted to march right back in there and gobble up a bunch closer to $1800.

In the meanwhile, I am cheerfully short XME, which I think could be one of the best ETF shorts for the rest of the year.