Artist’s conception of the Boeing 737 MAX design process (photoshop via Hiking in the Light).

Options Market Sentiment Turns Positive On Boeing

When I wrote about Boeing (BA) earlier this year, I quoted the infamous internal emails that described the crash-plagued 737 MAX as an airplane “designed by clowns, supervised by monkeys”.

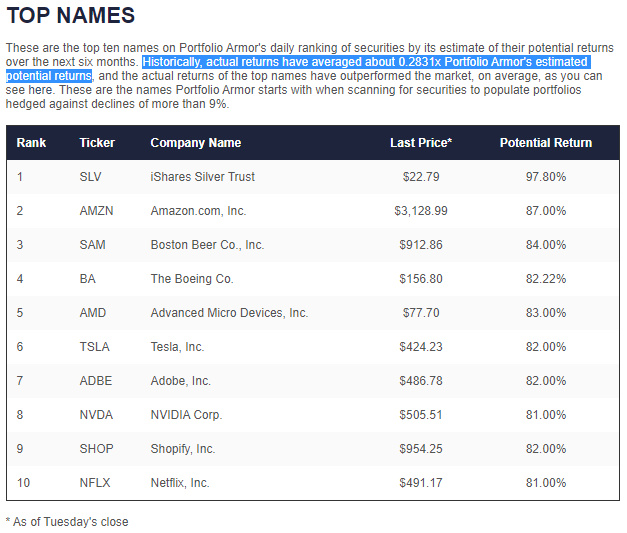

So I was a bit surprised to see Boeing appear among our system’s top ten names on Tuesday.

Those names are selected largely based on options market sentiment. Why might options market participants be bullish on Boeing?

What Are Boeing Bulls Thinking?

It seems obvious why options market participants might be bullish on other names in the top ten. For example:

- The iShares Silver Trust (SLV) – record fiscal and monetary stimulus weakening the dollar.

- Amazon (AMZN): COVID-19 lockdowns and rioters have wrecked a lot of its local business competition.

But why might they be bullish on Boeing over the next several months? Could it be Boeing’s new UV wand to sanitize airliners?

Boeing’s UV sanitizing wand in action (image via Airliner Ratings).

My guess is their near term bullishness rests on two main factors.

- Lack of competition. Airlines looking to buy jumbo jets are faced with a duopoly: Boeing and Airbus. The occasional 737 MAX falling out of the sky is fatal for its passengers and crew, but not for Boeing.

- Hope for a return to normal after the election. Some observers have speculated that the continued COVID-19 lockdowns have been driven in part by politics. If that’s true, then there will be less reason to maintain the lockdowns after the election. And a decline in lockdowns may release pent up demand for travel which could spur airlines to order more planes.

That second factor is supported by push back against the lockdowns from within the medical community globally.

Another Possibility

Another possibility is that Boeing bulls are simply wrong, and our system was wrong to select Boeing as a top name. In the event that ends up being the case, here are a couple of inexpensive ways cautious Boeing bulls can hedge their risk using our app.

Note that the last hedge shown in the video above essentially pays longs to hedge between now and November, as it offers a net credit. Something to keep in mind if you’re betting on the “clowns” and “monkeys”.