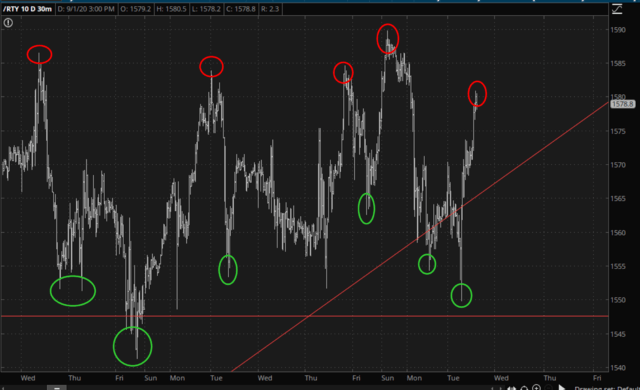

The small caps want to break. They really, really want to break. Yet the sides are evenly matched. On one side, cold reality. On the other, a hot printing press. Watching prices ricochet up and down in perpetuity is getting embarrassing. Honestly. This is a joke:

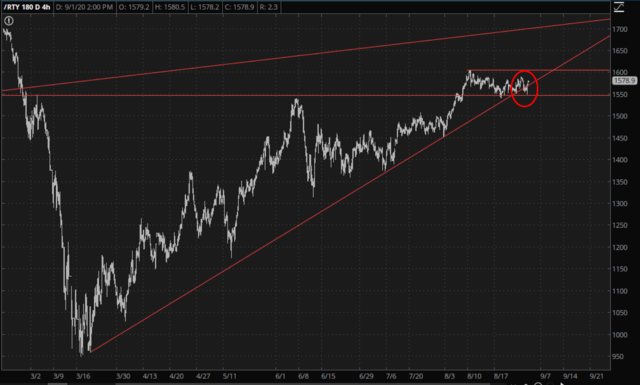

The longer-term picture shows that the /RTY has indeed fracture its uptrend, but it hasn’t “let go” because it isn’t being allowed to do so.

I would like to be extremely aggressive. This is, simultaneously, an equity bear’s greatest opportunity and most horrendous living nightmare. If the idea is to short overvalued stocks, it’s a candy store. But, as clearly has been shown, overvalued can go to insanely overvalued. If companies like Tesla has be brought with P/Es of 1300, anything is possible. If a one-trick pony like Zoom can be worth more than General Motors or Ford, we’ve clearly lost our collective marbles.

Thus, I’m dialed it back to 54 live short positions and 63 potential ones waiting in the wings. Historically, September is supposed to be the most bearish month of the year. Since these are, shall we say, nor normal times, I’m counting on nothing.