Maybe it’s my imagination – – or, better yet, maybe one day I should just analyze it scientifically – – but doesn’t it seem every FOMC week is the same? Specifically:

- Day by day, the market creeps up higher as Powell approaches;

- The bastards at the Fed do their stupid announcement, and the market lurches a bit, but gets on its feet and really starts climbing;

- Powell answers softball questions (or ducks hard ones), and the market by and large holds strong right until the close.

- The next night, the world realizes the man doesn’t know what the hell he’s doing, and it sells off.

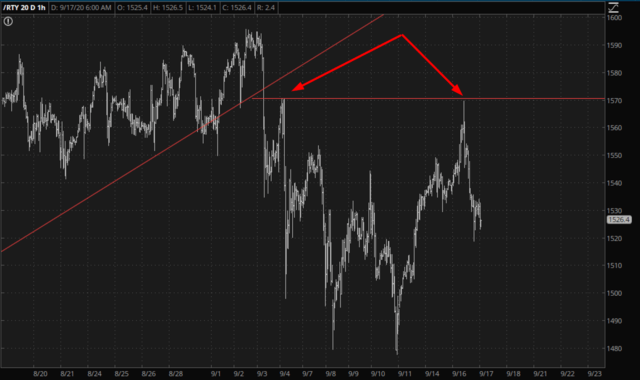

Indeed, the Russell (/RTY) got terrifyingly close to a breakout yesterday (circle) but retreated.

The prospective breakout is easier to see here, as the horizontal is anchored to an important prior intraday high. It’s nice that we’ve been beaten down some, but we can’t really start cooking until the lows of the past few days are taken out.

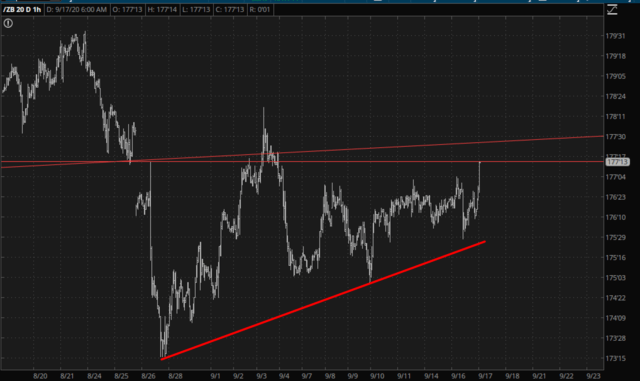

Simultaneously, as I suggested they might yesterday morning, bonds have been strengthening. This is an alluring right triangle pattern which is at the cusp of a prospective breakout (as we saw with the RTY above, however, breakouts can fail!)

I would love to see bonds burst higher, since:

- Higher bonds equals lower interest rates;

- Lower interest rates means banks suffer;

- Banks suffering means the small caps suffer;

- Tim’s a happy guy for once

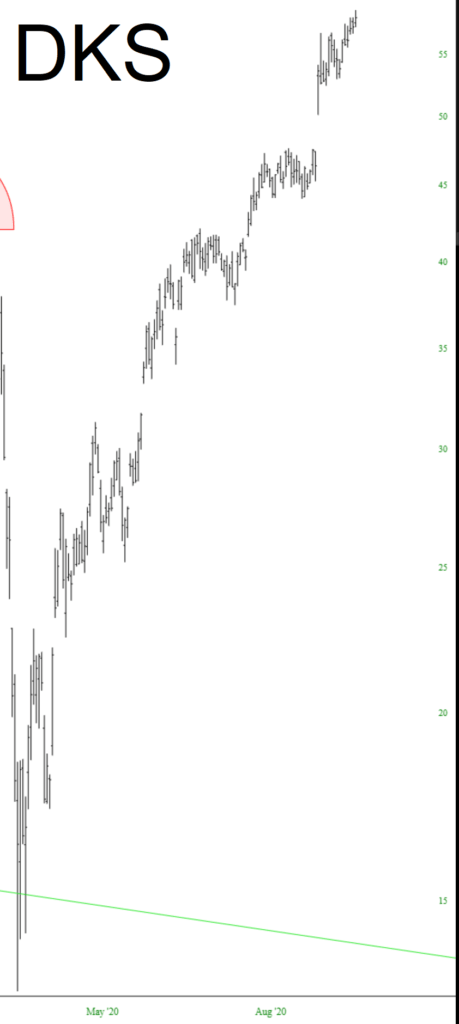

I’ve got 52 short positions and am 146% committed. I’ve got to say, I’ve chickened out again and again from otherwise good positions (like CBRL, I’m sad to say) because of the psychological trauma this market has dished out recently. I’ve got Dicks On the Brain, I guess, since stocks like this never seem to freaking break. Jesus!