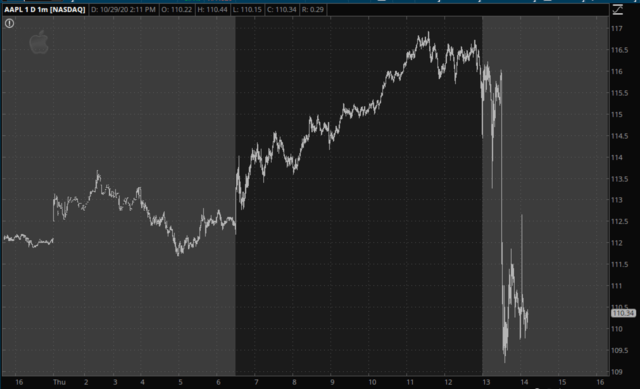

Well, it’s done. We’re past the lion’s share of earnings reports for the year 2020, and the initial reactions are tumbling in. First of all, Apple – – the largest company in the world – – and a massively overvalued, plodding, low-growth giant – – is succumbing. What’s awesome is that earnings on all these companies were out-of-sight and blew away expectations, and yet people are still screeching for the exits.

Amazon, too, is seeing some of the air come out of its overinflated tires.

One particular bloodbath is Twitter, which is getting its 140-character butt kicked.

The one exception is Google (oh, excuse me, Alphabet) which is seeing a strong push higher at the moment.

All in all, though, not exactly the elixir the bulls needed. My speculation that perhaps Thursday would be “all the bulls got”: might turn out to be the case.

Still, I can’t help but wonder if just a single trading day is enough suffering for the beleaguered bears to endure before the fun begins anew. I remain relatively light – – 45 positions at a 112% commitment level – – and 100% cash in my options account. I’m itching to get heavy, but I’m inclined to hold my breath until at least Wednesday to do so.