First, kindly bow your heads and join me in a moment of silence for this poor bastard.

What I’m referring to, of course, is the incredible limit-up day on the small cap futures. First off, /RTY went limit-up, so anyone short could not get out. So you can imagine the agony of someone already short these suckers, just waiting for the opening bell. And then, the millisecond the bell rings, it goes another “limit level” level (another 7%, I suppose), and a bunch of folks get stopped out instantaneously, breathing a sigh of pained relief.

And then it proceeded to undo virtually the entirety of both limits-up.

It was even kookier in the NQ world, which saw its price drop to some of the lowest levels last week, as the possibility of spending the rest of eternity all in our houses, binging on Netflix, peddling on our Pelotons, and doing meetings on Zoom – – all simultaneously, of course – – was quickly dispatched.

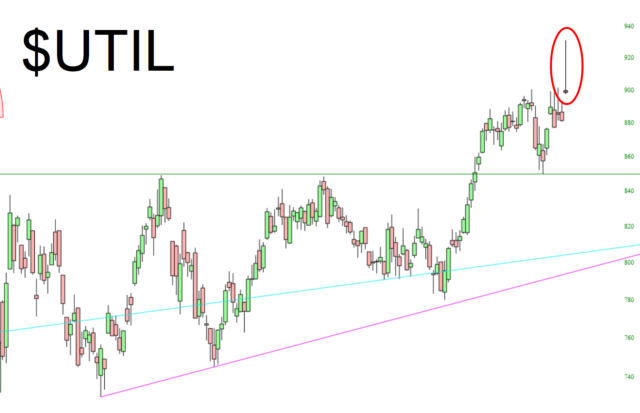

The explosive open created some of the most insane daily bars I’ve witnessed in a long time. The Dow Utilities is the greatest example of a shooting star, straight out of Technical Analysis 101, I’ve ever seen.

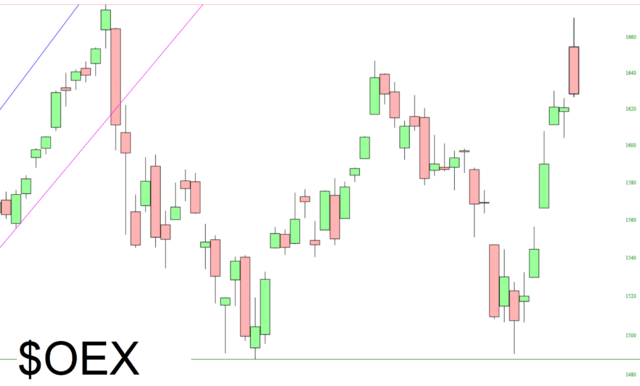

Although many indexes reached lifetime intraday highs (with the Dow managing to tag 30,000 for a moment), a handful did not, such as the S&P 100.

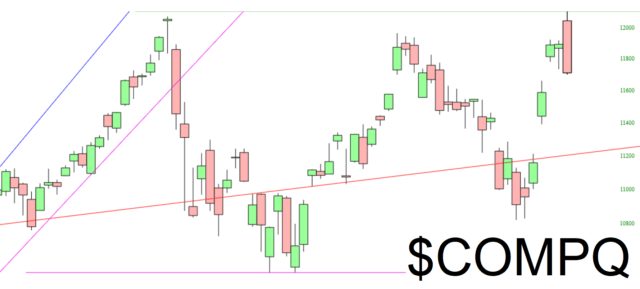

On an intraday basis, the NASDAQ eked out a lifetime high, but at the end of the day, a bearish engulfing candle was the result.

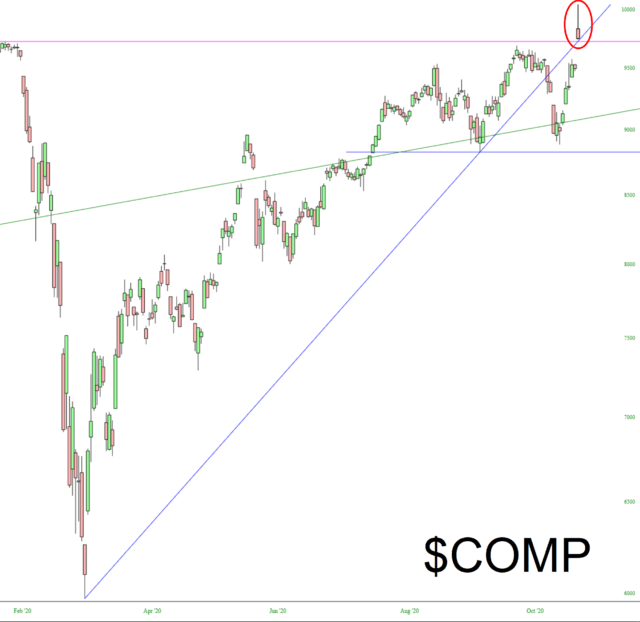

Getting away from tech, we see below the Dow Jones Composite (AKA the Dow 65 index). On the one hand, the bulls won the day with a lifetime high and a burst through some very powerful lines. On the other hand, you’ve got another shooting star, and we’re teetering precisely at both the horizontal and diagonal lines.

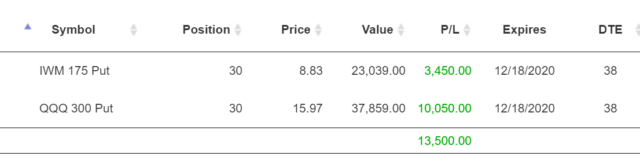

I was pretty much a wreck all day, but I managed to punch in a couple of big options trades in Virtual Trading, and those worked out so far.

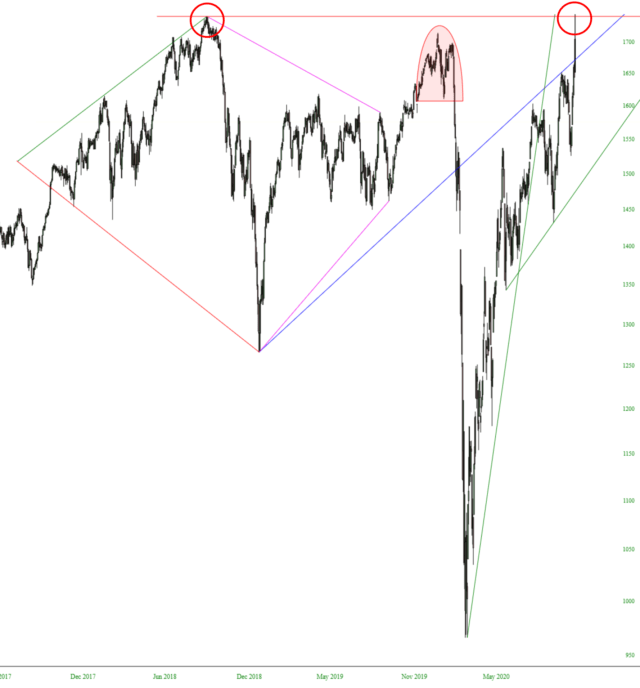

The most important index to me remains the Russell 2000. Yes, there was an intraday lifetime high (by literally 17 hundredths of a single percent). However, let’s consider this a double top until the market actually validates this as a new, lasting leg of the ongoing bull market. We are really quite “extended” at this point.

In general, this is the best summary I’ve seen anywhere of November: