For those who don’t know, GEX stands for Gamma Exposure. It is an options-based LEADING indicator that is derived through a calculation of all the gamma at all strikes and expirations on any given day in the S&P500 Index. The chart is free to access and can be found here.

High Gamma = high pushback against selling and Low Gamma = low pushback against selling.

As of Friday’s close, Gamma Exposure hit a very low point. A key point in a couple of ways.

The first is that it was less than 1.5B. When gamma gets this low it tends to be associated with falling prices and increased volatility.

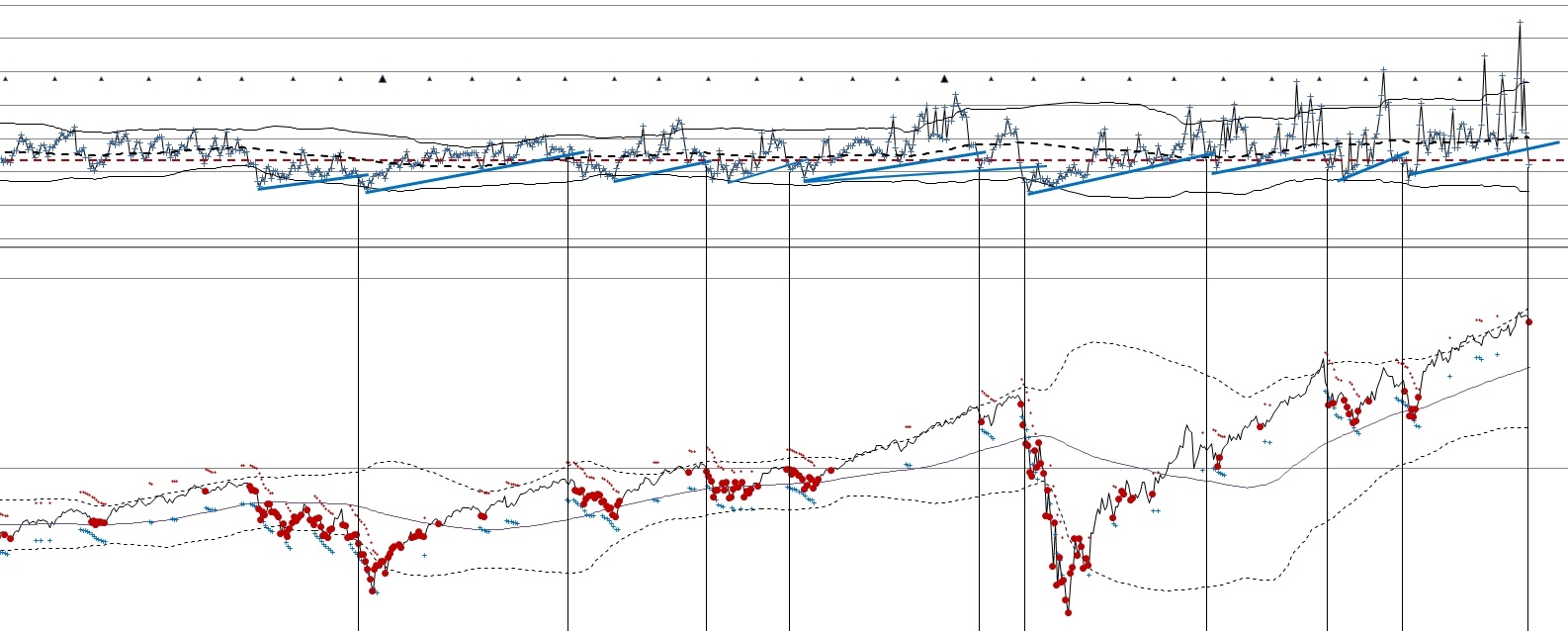

The second is that GEX broke its uptrend line. I’m the only one I know of that uses it this way. You see, a little while back, I was doing some ongoing testing and analysis of the GEX and noted that it seemed to trend along with the SPX. Out of curiosity, I drew some UTL’s and plotted what happened when they broke down. I was surprised and amazed at the results. It was consistent going all the way back to the start of the data in 2011. Red dots are when GEX is <1.5B (GEX above, SPX below).

When both a months-long UTL broke AND Gamma Exposure dropped to <1.5B, it was a really good marker of an imminent period of selling. More often than not it is EARLY which I love.

It seems the target when coming off of weekly Bollinger highs is often the 20wk moving average, currently at $351. Of course, there is the added detail of extremely low Equity Put/Call levels so if this runs away, it could really get going, but let’s see how things progress. At this juncture, the 20wk MA is a high probability first target, IMO.

A closing break of the 20 DAY Moving average should seal it and trigger further selling.

As always, a stop is your best friend in trading. Sometimes, there were shorter-term UTL’s that broke and were quickly recovered. Generally though, most UTL’s that were longer than a couple of months resulted in decent pullbacks or outright corrections.

Good luck!