Well, let’s set aside the GME-zaniness for a bit and recognize that there are, in fact, some other stocks in the market, and when taken together, these stocks can create index values. I have a few words to say about each of the seven charts below.

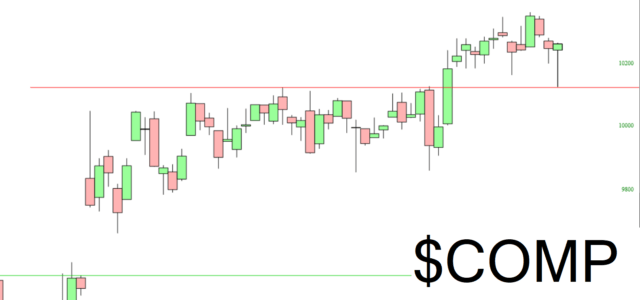

First up is the Dow Composite. I drew that horizontal line a while ago because of its old range, and today’s (brief) tumble tagged that line perfectly. We need to break it on order to give any surviving bears even the tiniest chance.

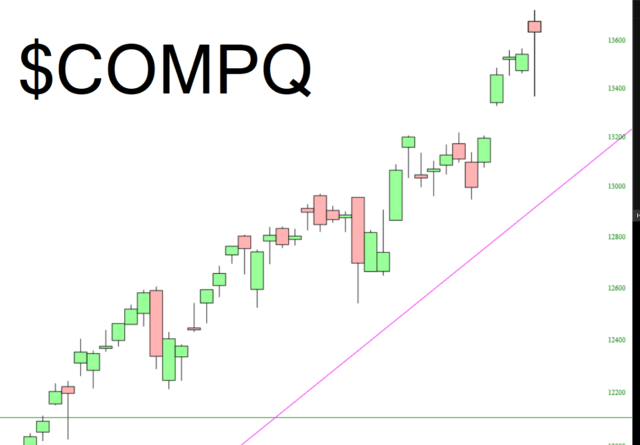

The NASDAQ Composite is definitely “on deck” this week, with all of the mega-mega-caps reporting. We remain well above any risk of trendline failure (the line, incidentally, goes back to the March 23rd bottom).

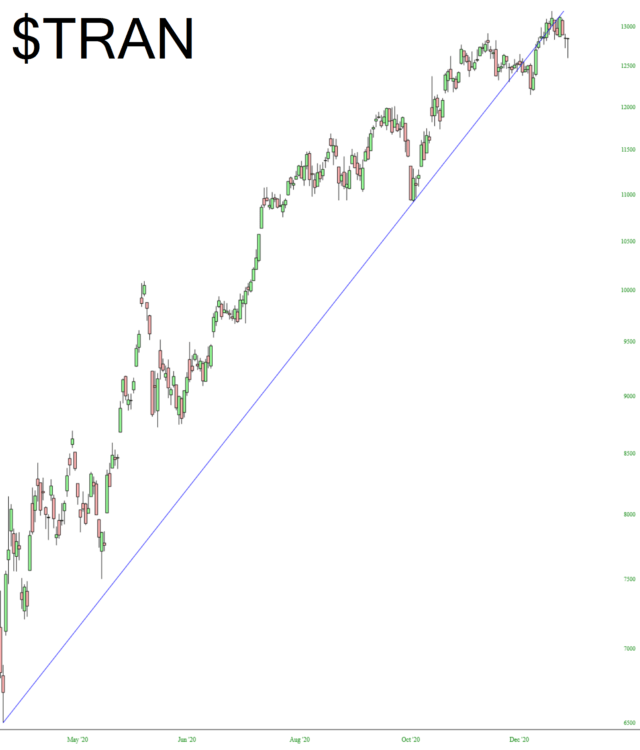

The Dow Transportation index is the only outright trendline failure out there. This is the only sliver of light in the dark, dark world of ursa.

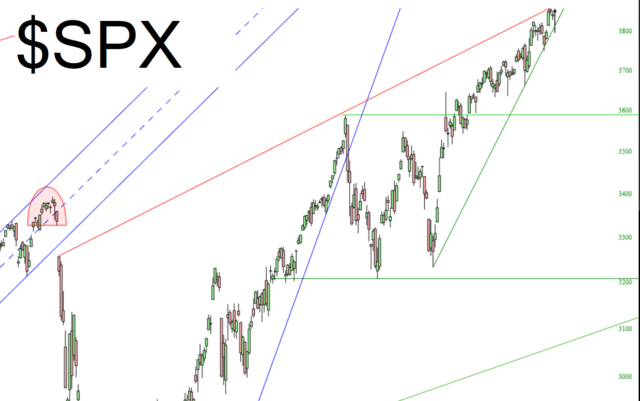

The S&P 500 remains in a beautifully-formed terminal wedge. C’mon, baby, break!

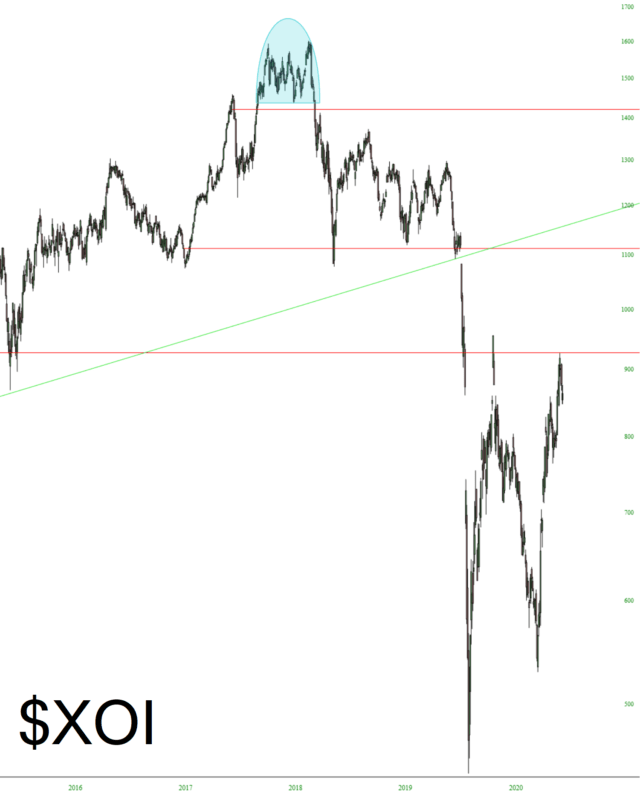

My favorite index remains the oil sector, which continues to sink away from a gargantuan overhead supply.

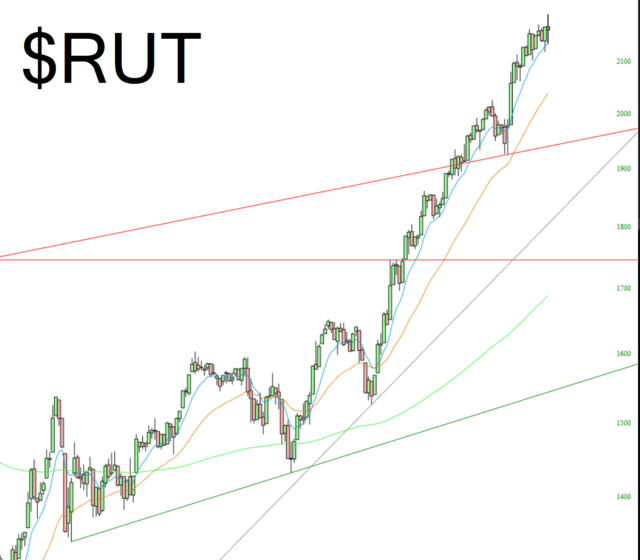

The Russell 2000 has been in my oh-m-God rally for months. This trio of EMAs is supporting it the whole way. I bought March puts on it today.

Finally, here’s the VIX. Notice how it PERFECTLY tagged the descending trendline. So close, but not enough!

Here’s looking forward to more GME-madness tomorrow………