In late May of last year, I did a post called The DMC Challenge which had a very simple premise: I would take a hypothetical $500,000 wad of cash and put all of it into my best long ideas and best short ideas, evenly distributed among every symbol, and see what happens. When I did the post, the first comment was:

Well, it’s been almost eight months, so let’s check in on the Devil May Care portfolios!

Since the time of the post, the S&P 500 is up a little more than 30% and the small caps are up almost 60%. It will come as a shock to absolutely nobody that the DMC Long vastly outperformed the DMC Short portfolio, but I find the results fascinating nonetheless.

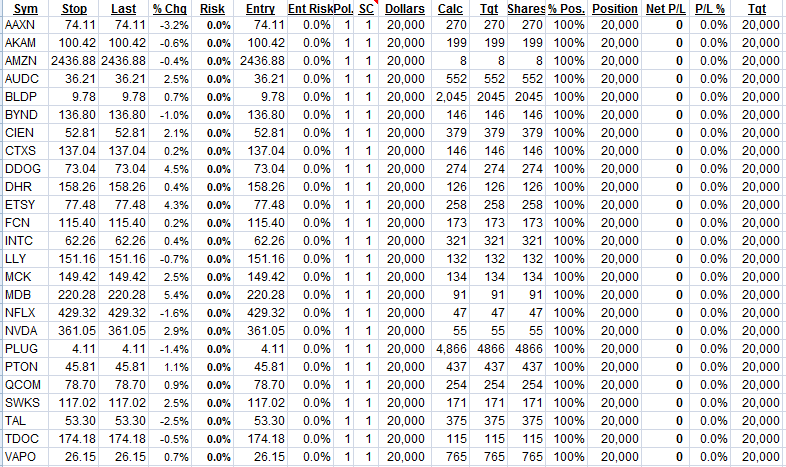

The DMC long started like this, with $20,000 in each position……..

As of this moment, one-fifth of the longs yielded a loss, with the worst one being down almost 18%. However, this is utterly dwarfed by the gains, three of which are triple-digit percentages and one of which is a quadruple-digit percentage.

Plug Power yielded profits of almost a third of a million dollars from its original $20,000 position. Overall, there is a gain of 112%, which is three times what the S&P 500 has gained. Simply stated, Tim the Permabear didn’t do a bad job picking out longs.

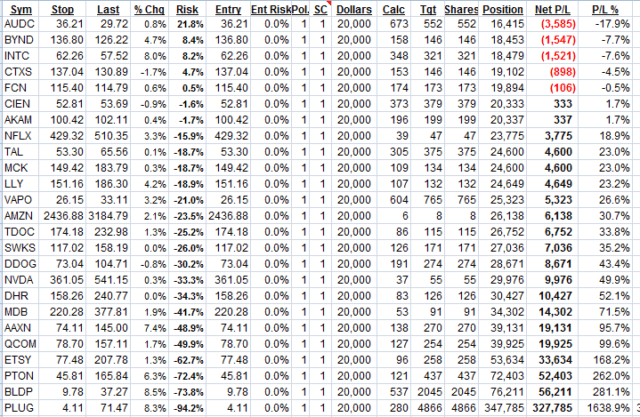

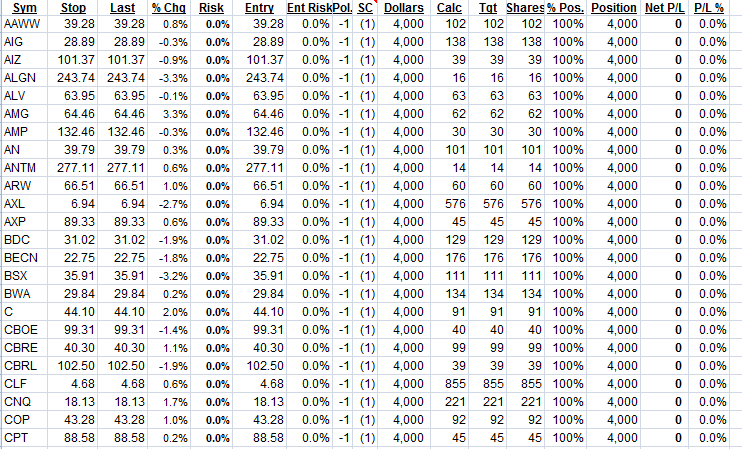

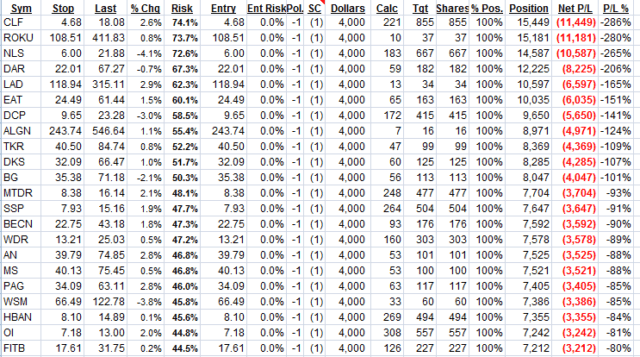

There were far more short candidates – – five times as many, in fact, so the starting positions were only $4,000 each.

Keep in mind, the whole idea of “devil may care” was that there would be no stop losses. And, thus, some of the losses in these short positions are monstrous, such as the nearly 300% loss with CLF. No sane person would ever endure this, but the portfolio suffered a loss of about 51%.

What’s kind of interesting is that if you started with a million dollars and allocated it the way I did above, your combined portfolio would be worth about about $1.3 million right now, matching the S&P 500’s.

Big deal, right? But it is kind of a big deal, because you started off with a totally balanced portfolio, and even though this hypothetical person can absolutely ravaged by huge losses in the short portfolio, in the end, he produced a return every bit as good as the S&P (although, let’s face it, just owning the SPY would be less stressful!) If the market had gone into a tailspin, I doubt the portfolio would be down nearly as much as the market overall.

Here, finally, is the champion of DMC Long, which has made a habit of going up basically every single weekday, and whose gains single-handedly would have wiped out all the losses from the DMC Short portfolio and still have yielded a triple-digit cash profit.