Now that we’re heading into the earnings season, I wanted to point out the vast amount of information on Slope you can discover about any given stock. Let’s take this afternoon’s hot report, Tesla. You can look at the price cone to see what the options market is doing:

There is implied volatility (which has been degrading steadily!)

The IV Rank:

The historical behavior of the leading up to, and following, earnings:

The Seismograph:

The date analysis (showing here what a killer year 2020 was for TSLA):

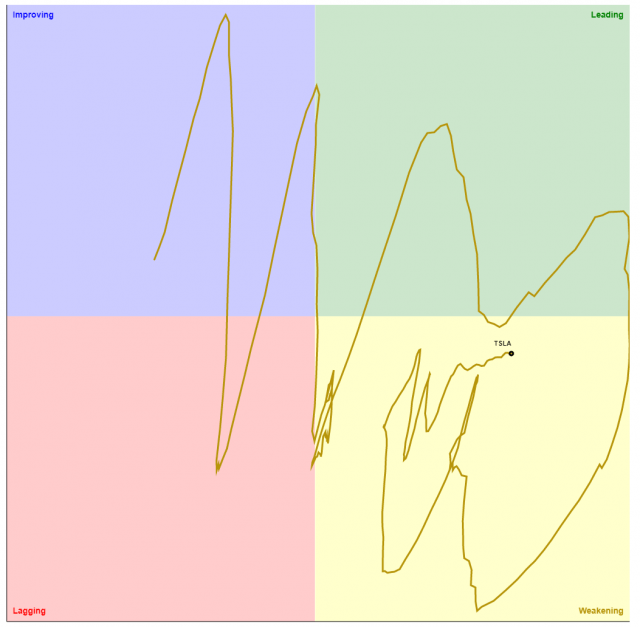

The relative strength graph (RSG):

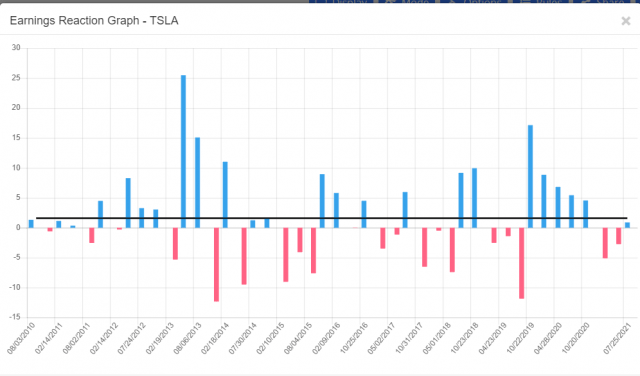

Past earnings reactions:

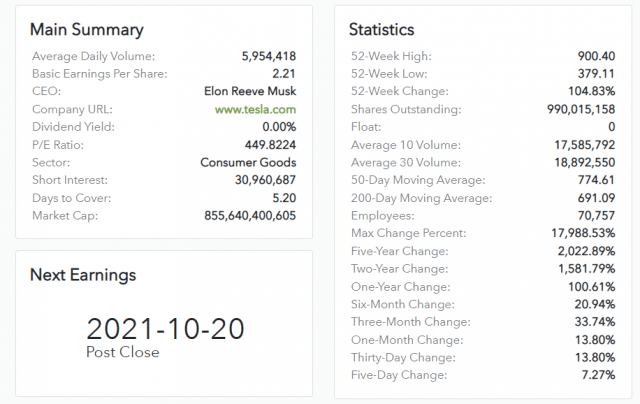

The Super Summary:

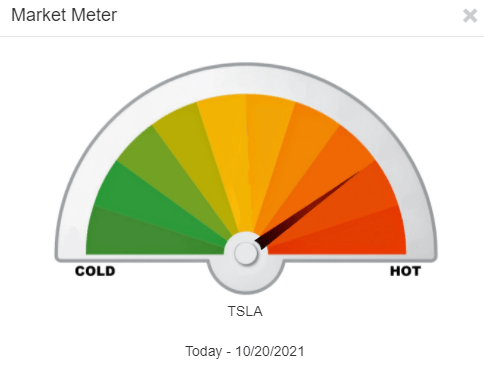

And the Market Meter. PHEW!

And if that’s all too much work, you can just stare at the most expensive item sold yet from ticker.art which is the TSLA piece: