A natural gas plant. Photo via Colonial Energy.

Mild Winter Weather Isn’t Helping Natural Gas

Sometimes, all I think about is you

Late nights in the middle of June

Heat waves been fakin’ me out

Can’t make you happier now

– “Heat Waves” by The Glass Animals.

The song “Heat Waves” came to mind last weekend, as temperatures in the New York area were in the 60s. This kind of weather has been a headwind for natural gas prices. It’s not what many investors expected a couple of months ago.

The View From October

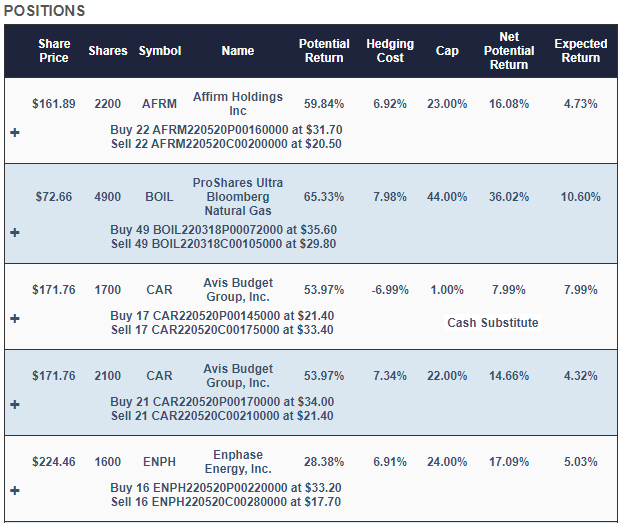

At the end of October, our system, which gauges stock and options market sentiment to rank securities, had two natural gas ETFs in its top ten: ProShares Ultra Bloomberg Natural Gas (BOIL) and United States Natural Gas Fund (UNG). Our system wasn’t the only one faked out by natural gas then. Our fellow ZeroHedge contributor editor, Kimble Charting, saw a possible upward breakout then as well.

Natural Gas Tanks Instead

Since then, UNG was down nearly 35%, as of Monday’s close, and the leveraged natural gas ETF BOIL was down nearly 61%.

Protection Against Being Wrong

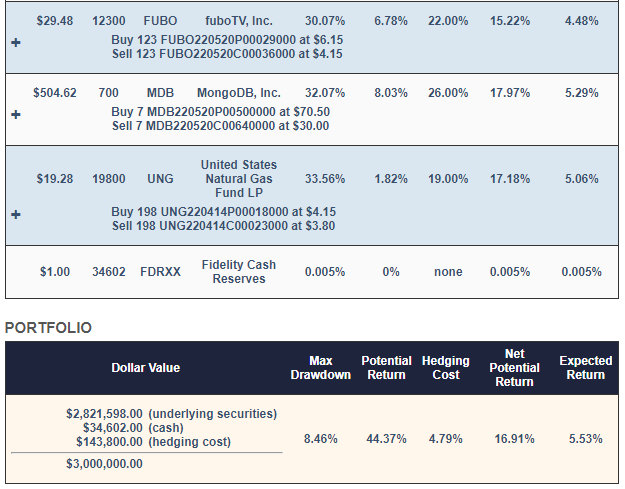

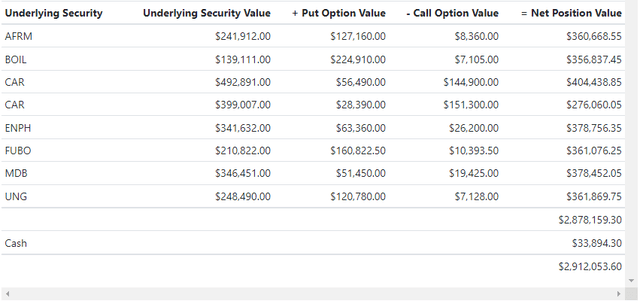

As it happens, both UNG and BOIL appeared in our hedged portfolios at the end of October, along with Affirm Holdings (AFRM), MongoDB (MDB), Avis Budget Group (CAR), and FuboTV (FUBO). This was the portfolio our system created for investors with $3,000,000 to put to work who were unwilling to risk declines of more than 9% over the next several months on October 28th (note that these portfolios can be created for dollar amounts as small as $30,000).

Screen captures via Portfolio Armor on 10/28/2021.

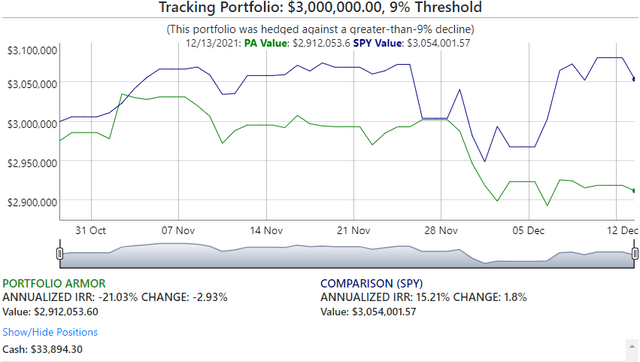

Ordinarily, when you’ve got two names down 35% and 61%, respectively, in a concentrated portfolio like this, you’d expect to be down double digits overall. Here’s the actual performance of that portfolio so far.

Thanks to their hedges, the BOIL and UNG positions were only down about 5.4%; overall, the portfolio was down 2.93% overall, net of hedging and trading costs.

A Chance To Be Right

If natural gas prices spike in the next few months, all else equal, the portfolio above should rally to a gain; if not, its downside will be strictly limited. One additional step we suggest to smooth out returns with these portfolios is to split your money into a few tranches, so you can put a quarter or a third in a hedged portfolio now, the next tranche in two or three months, and so on. Since our hedged portfolios are designed to last for six months, this means you’ll have four to six entries per year. That means you’ll have that many chances for our system to be right. And when its wrong, your downside will be strictly limited.