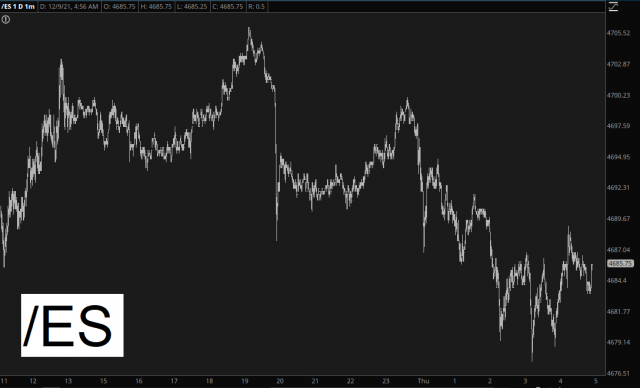

Good morning, everyone. And I can say that for the first time this week without wincing, since we actually have some red on the screen. The insane “hey Omicron won’t kill us all” rally from Monday and Tuesday seems to have run its course. The damage was absolutely horrific, with some indexes are new lifetime highs and the Dow slapping on thousands of points. Madness. Sheer madness. So the NQ, RTY, and ES are all slightly red now.

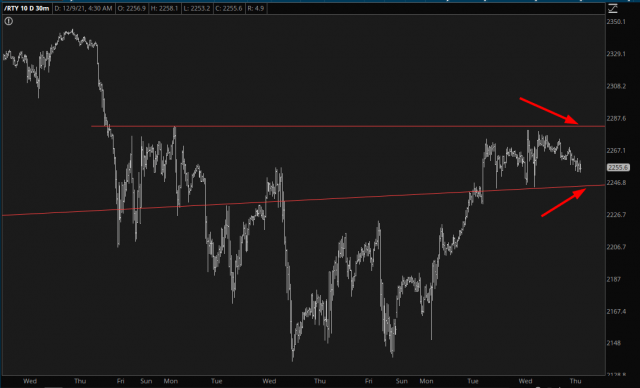

The “squeaky clean” bearish setups were wrecked the moment the market opened on Tuesday, and I think the situation we’re in now is neatly represented by the small cap futures. The top arrow shows the line which, if broken, will probably send the markets higher for the rest of 2021. The lower arrow shows the line which, if broken, would throw cold water directly into bullish faces and start bleeding out prices again.

We were vomited into this zone by the mayhem of Monday and Tuesday, and on Wednesday the market pretty much sat around picking its nose. I strongly suspect that 24 hours after I’m typing this, when the CPI number is released, this tension will be resolved.

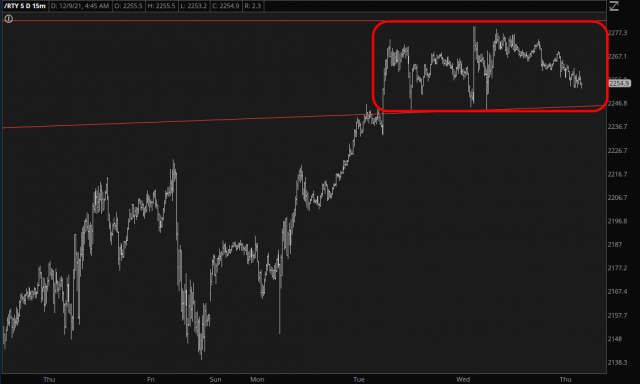

Here’s a closer looking at the same market to illustrate how cleanly boxed-in things are.

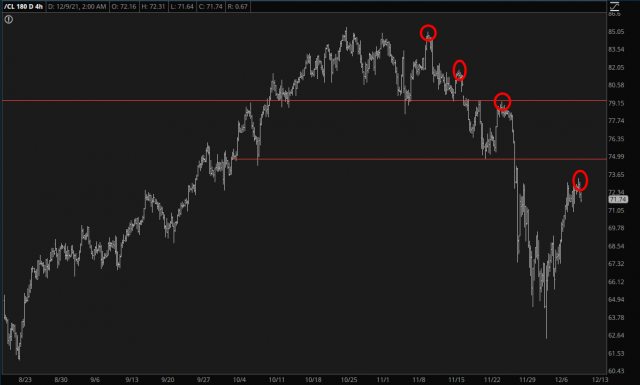

I said yesterday, and I’ll say again, crude oil is my lamp light. This is the cleanest in-your-face bearish setup around. It is absolutely SCREAMING to resume its downtrend. I daresay the entirety of the recovery is, thank heavens, behind us.

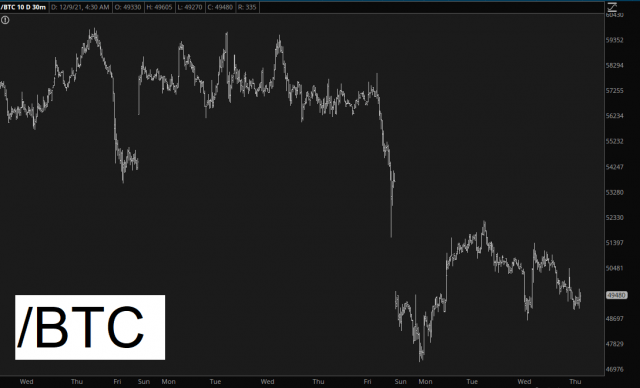

As for crypto, I believe this market was irretrievably broken, at least for the next few months, if not for most of next year. The funny thing is that Buy the Dip has been burned into the public’s DNA across all asset classes. I’ll be interesting to see how dip-buyers ultimately reflect upon this decision, because I believe in our tragically consumerist culture, the notion of buying stuff when it’s “on sale” is ineradicably woven into the social psyche.