Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

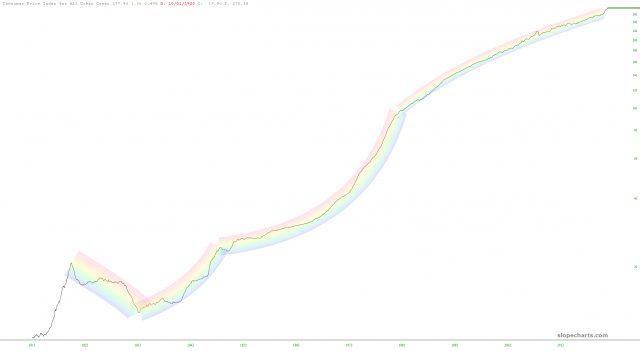

The Fed’s Inflated Cake

A stroll through recent and not so recent inflationary history

A Cynical Fed is a Dangerous Fed

On ‘Fed minutes Wednesday’ the media amplified the noise, the machines are doing what the machines do and running with it, and it’s all eyes on the great and powerful Fed (of Oz).

The Fed created the cyclical inflation (in NFTRH we detailed and managed the process successfully in real time) and thus the Fed created the cycle. In 2021 the Fed was exposed to the public as the agent of inflation it actually is, and when the inflation threatened to get out of hand they went into damage control mode. Now the Fed is trying to cool the inflation, which means cooling the cycle itself. You can’t have your inflated cake and eat it too. Not when the racket is exposed to the public.

(more…)Inflation’s Rainbow

The Memes of Yesteryear

AMC Entertainment has lost two-thirds of its value in less than a year’s time, and yet it remains one of the most consistently popular tickers to trade, with tens of millions of shares trading every single weekday. I’ve never understood the appeal of a company which is technically insolvent and has such a grim future, but the /WSB crowd is weird, man.

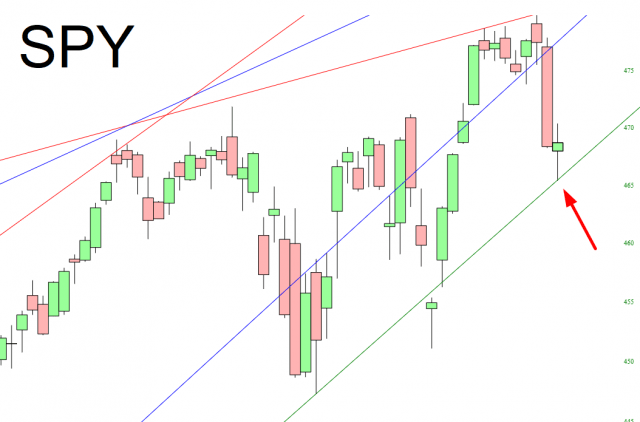

Another Support Line

After yesterday’s terrific plunge, I dialed up my cash levels from 5% to 35%. I remain in 18 bearish positions now, expiring anywhere from 71 to 162 days from now, so I’ve got ALL the time in the world. I think I’ll hold back before piling into more positions. I took profits, for example, in ADSK, CHTR, CVNA, and UPWK. Time to watch from a distance, I think, and at least see what tomorrow’s jobs report does to prices.