Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

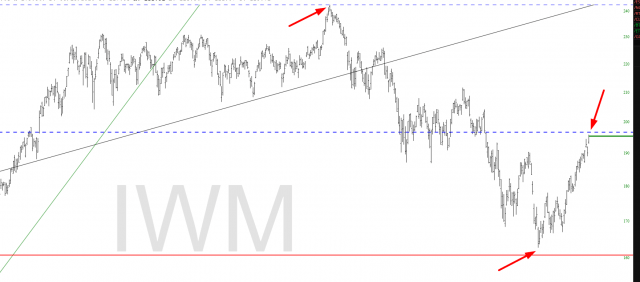

Russell 2000 Retracement

Please note this vitally important retracement level on IWM. We peaked on November 8th, ground our way down lower through June 16th (eight months of bearish deliciousness!) and then have spent the past two months in this hellish, awful, horrific counter-trend rally, which has just about nailed the major Fibonacci level to the penny.

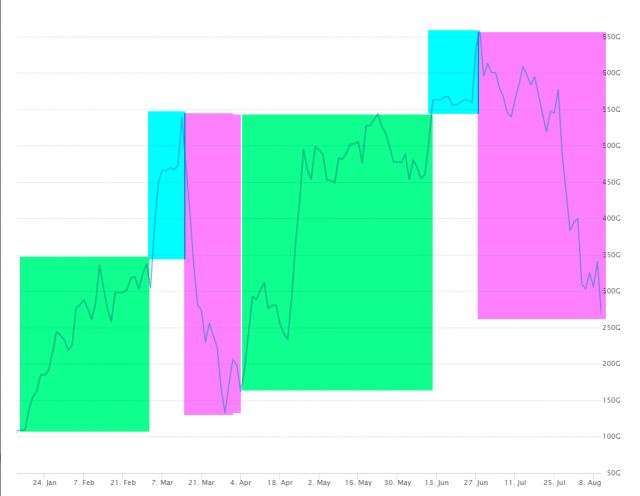

Post-Massacre Analog

Last time my virtual portfolio went through this midnight prison-raping ended on March 29th, with the main difference being THAT counter-trend rally (about which I whined endlessly) lasted two WEEKS, whereas this goddamned cursed soul-sucking monster has been going on for TWO GODDAMN MONTHS. Behold my loss of, yes, $400 BILLION dollars………..

Rough and Raw

Well, THAT was a shit sandwich! At least for any bears besides me. Jesus!

I was watching the CPI release with great anticipation. You can imagine how I felt when I saw that think spike go raging higher on the screen. It felt like an OHLC bar was being shoved through my stomach. So it seems that the Sloper verdict about how tame inflation would be was on-the-mark.

The only things I did right over the past two days were:

- Dumped my SPY puts yesterday at a profit;

- Wasted no time dumping my IWM puts at the opening bell this morning at a smaller loss than I would have endured;

- NOT deploying more cash into positions, and instead tucking it back into the safety of my checking account, where the mean old bulls can’t get to it.

Netflix

The lifetime chart really showed the story here. After NFLX had collapsed 77% in a matter of months, it managed to traverse its lifetime channel range and tag its supporting trendline beautifully. It was one of those once-in-a-blue-moon kinds of moves.