Short and sweet – – I like the look of the Materials ETF (symbol XLB) and have bought January $80 puts on it.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Short and sweet – – I like the look of the Materials ETF (symbol XLB) and have bought January $80 puts on it.

Just a couple of quick tidbits to share. First of all, although I think the bear market has scads of downside left, I’ve eased off in a few positions – – mostly energy, which continues to suck for the bears – – and am up to 25% cash. A nice hearty “buy the dip” bounce would be great, but it may or may not happen. I went from 34 to 28 positions and am probably done for the day. The point is that I was “pedal to the metal” at the open this morning but shaved off six positions completely and trimmed a few back to smaller size.

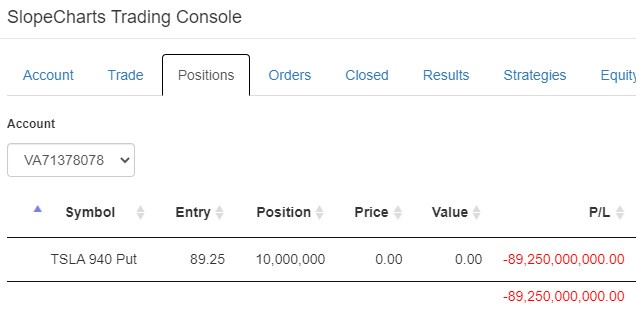

Second, none of you should really care, but just FYI, in virtual trading, it doesn’t deal with corporate actions. In particular, I had a huge TSLA put position, but since they split 3 for 1, I’m doomed to lose $89 billion on it, no matter WHAT the company does. My poor account! Oh, well. It’s only (fake) money.

I tried. I honestly tried. Most of you believe me. Some of you don’t. But the power of Bear Force One, as tracked by our own Event Markers feature, is no longer in dispute, even by the most skeptical scientists and metaphysicists.