I look at a lot of financial sites, and if there’s one universal theme out there it is this: The Market Is Going Higher, 100% Guaranteed. The financial airwaves are positively flooded with this notion. Even ZeroHedge, which used to be a fairly bearish site, is ga-ga about buying stocks (slavishly following the advice of Goldman Sachs, of all things) and, incredibly, buying Bitcoin. It’s a pretty eye-popping sea-change.

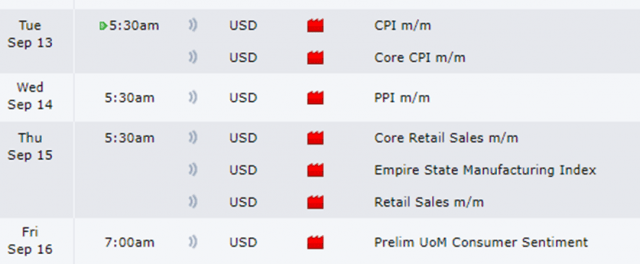

What you’ll also read a lot is that All Eyes Are On Tuesday’s CPI, which is understandable. After all, two months ago, the CPI surprise led the equity market lower, although one month ago, inflation surprised to the downside, so stocks strengthened. The expert consensus is that prices are DROPPING. I’m not sure what planet these people are on, but OK, there ya go. We’ll know soon.

I’m typing this on Sunday afternoon, just after the futures markets started trading, and of COURSE everything is bright green in stock-land. Below is my best guess as to what constitutes the /ES top, and we’re getting extremely (and dangerously) close to its next resistance.

Somewhat less prone to bulls are the small caps, which are also approaching an important resistance level and have more formidable overhead supply.

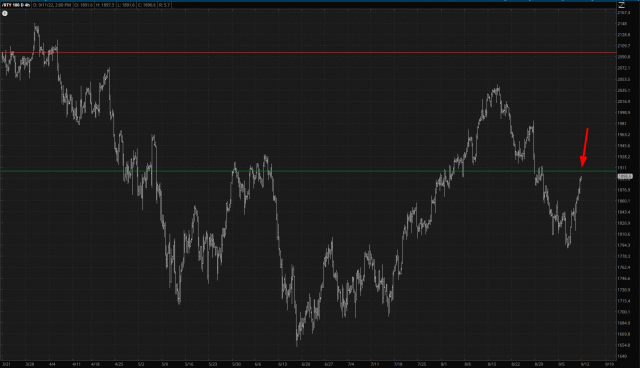

The cleanest topping pattern, by far, of the stock futures is the /NQ, which is why it’s the only one of these on which I have a position (long November QQQ puts, but not a big position). The market really needs to stop this assault fairly soon for the bears to have a fighting chance. Of course, we may just grind around and do nothing on Monday, due to the “All Eyes…..’ mentioned above.

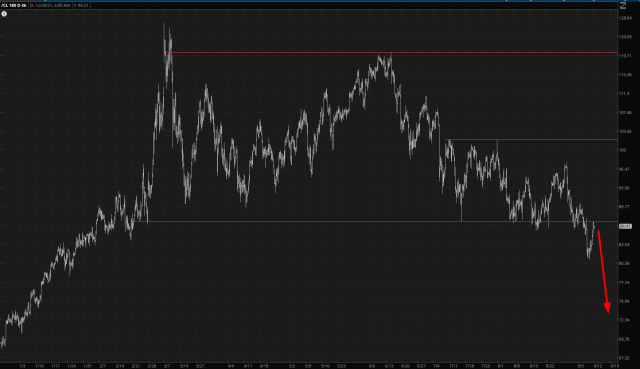

Energy remains by FAR my favorite bearish sector, and as I’m typing this, it is the only thing that’s even showing a small amount of weakness, being the only red number on my entire quote screen.