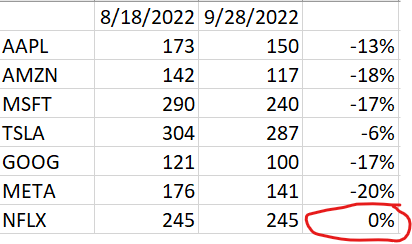

In mid-August, about two days before the ultimate peak, I had noted that many of the previous market leaders all had approached important long term resistance levels. Those market leaders were noted as AAPL, AMZN, MSFT, TSLA, GOOG, META, and NFLX. Since that day, many of these came to be wonderful shorts (had I been able to short) except for NFLX:

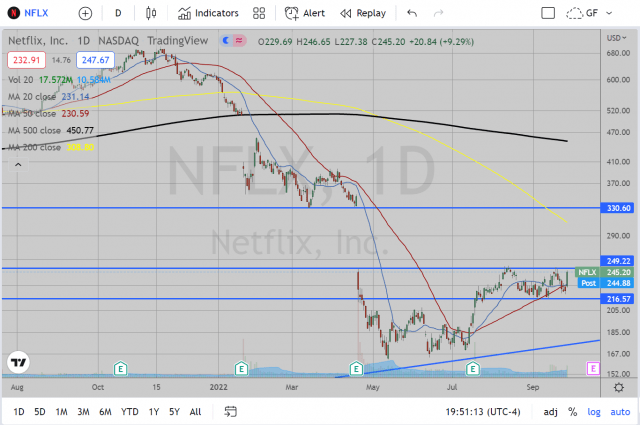

TSLA is a close second in terms of my frustration, but the focus of this post is NFLX. After this stock’s weakness earlier in the year I would have hoped it would follow similar trajectory as META. It has instead become stuck in this range between 216 and 252 where it has been since July 27, just about 2 months. Leading up to this week I had hoped this would resolve downwards, each time finding support, leading us where we are today. Today’s action seemed to have been triggered by not one but two upgrades due to its upcoming ad-supported tier. This makes sense as this is something that can open up a new wave of customers for this stock which, for a while, seemed to have hit a wall with potential new customer sources.

However, I still believe this is subject to the broad market movements. If we see the broad market selloff, I fully expect this to break down below this range as well. The resistance at 250 goes back to December 2018 and September 2019 when it was previous support, so I give a lot of weight to this resistance level. As of yet, however, this is remaining the strongest of the former market leaders in the short-term. If this market does decide to bounce here, this may be an optimal stock to play on the bullish side. A breakout above 252 seems like it could yield a powerful bullish run with a potential target of 330, closing the gap from April Earnings. If not there, then there is also a 200 day EMA at 308 as of today (let’s round down to 300 to be conservative).

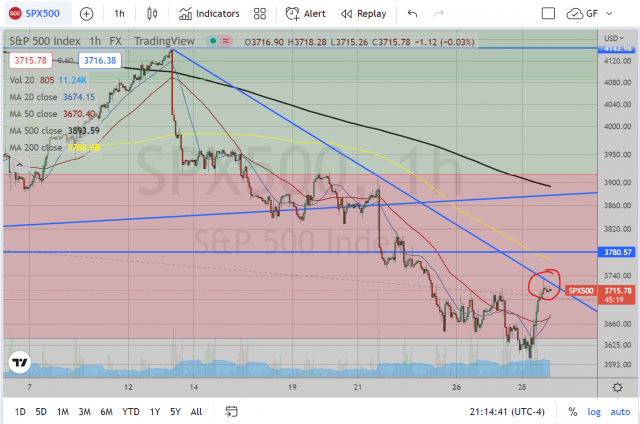

As always, I leave things off with a lot of “ifs”. I can’t say for sure what will happen, but just how I will play things should the market move where I am expecting. With a decent stop, one could ride the bullish wave up should this manage to breakout. The same could be done if the market breaks down. To put the bullish short term market potential into perspective, the end of day action in SPX (hourly chart) ticked the descending trendline from the September peak and is now fighting right there overnight. I kind of wish I hadn’t noticed this, but c’est la vie.