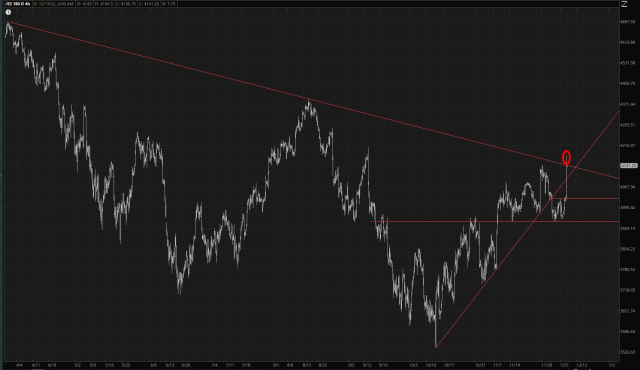

For the third time in a row, the CPI report has given the bulls a massive gift. As I’m typing this, minutes before the opening bell, the ES is up 125, the NQ is up almost 500, and it’s a total frenzy. Briefly, the /ES even pushed above its descending trendline.

You can see here this brief “poke” through the trendline which has defined the bear market for the past year.

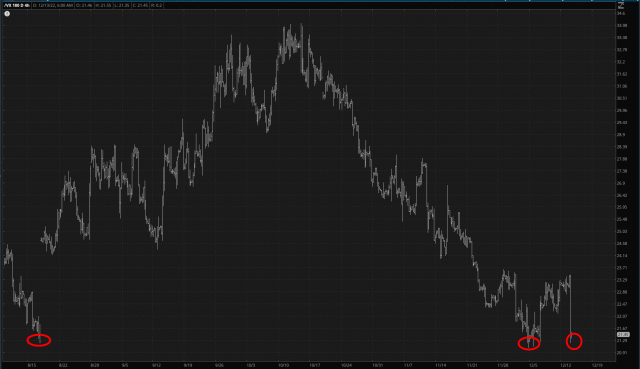

In turn, volatility (/VX) has been smashed down to match the lowest levels we’ve seen all year long.

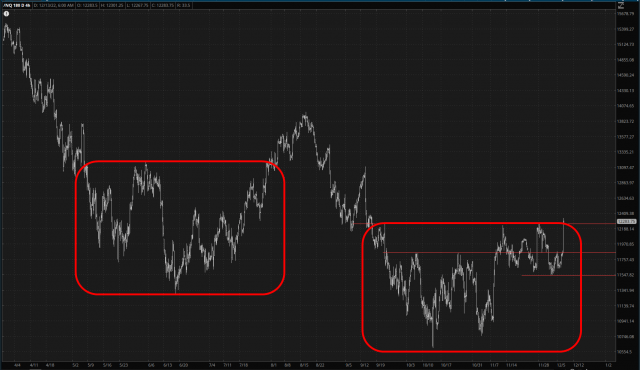

The cleanest setup for the bulls is the /NQ, which has the prospect of pushing up the rest of 2022 with additional gains. Most of the easy gains are already in the rear-view mirror, but if the past instance is as guide, this could run on vapors until we’re into the new year.

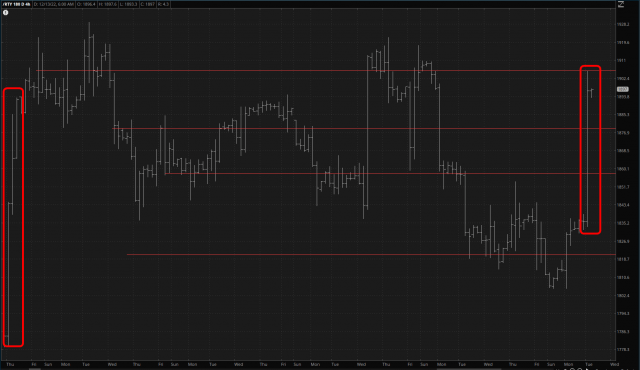

To see what a ping-pong match the market is, the /RTY shows that we’re basically at the same level we were the last time the CPI rolled out on November 10th. We’ve just been range-bound and banging up and down for a solid month.

As for myself, here’s my world as I brace for a rotten day:

- Based on nothing but raw fear, I sold my TLT puts yesterday at a profit and am in 100% cash. I might not touch this account until 2023, since it’s got good gains I’d like to preserve.

- In my big account, I’ve got 25 positions, but that’s bound to get beaten back some. I’m at 16% cash, but I’m confident I’ll boost that to about 25% as I trim the worst positions.

- The air probably won’t be clear until the end-of-day tomorrow, after the Fed has had its event.