Not Entirely Luck

Before the market open on Thursday, I shared my CPI Day Gameplan with my Substack subscribers: if the market rallied, I wrote, stocks at risk of bankruptcy would likely continue their rally, and I intended to buy puts on at least one of them. In a subsequent post that afternoon, I wrote that I had bought puts on Bed Bath & Beyond (BBBY):

As I type this [on Thursday afternoon], the stock is up 50% on the day and 212% over the last five days. The closest thing to a catalyst this week was its CEO not explicitly mentioning bankruptcy on their earnings call. My bet is that reality will set in and the stock will drop from here before these puts expire.

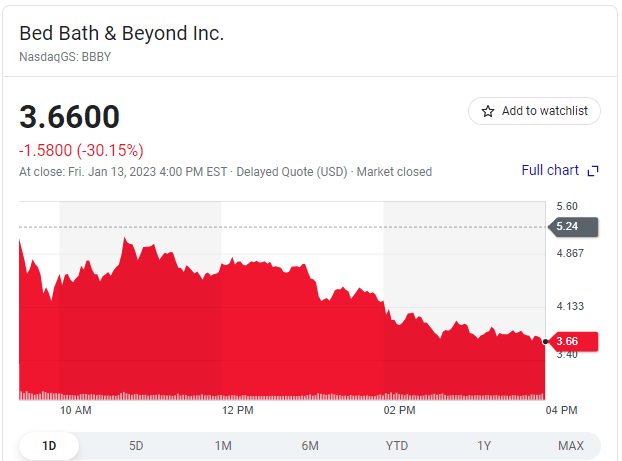

As it happened, the stock dropped the next day:

To be sure, this was partly luck: as I noted in my post, it’s difficult to time the top exactly in these kinds of trades. And it’s also possible the stock could rise again, though that seems unlikely given the news that the company is in bankruptcy talks with its lenders. But it’s not entirely luck. I also bought puts on BBBY during a previous (much higher) peak last August. Looking back, here are a few factors that worked in my favor:

- Have a broader thesis in mind. In August, mine was that Michael Hartnett’s call of a bear market rally top was likely correct; this time, it was that “trash stocks” (those at risk of bankruptcy) would likely have a last gasp after a CPI miss (the January CPI release was actually in line with estimates, but the market impact was similarly to that of a small miss).

- Have a stock or stocks in mind. If the market rallies, what do you want to bet against? If it plummets, what do you want to buy? The time to research these names is before the market reaction.

- Pattern recognition. Have a feel for when an irrational rally might peak. From previous CPI releases, I figured it might either be that day or the next day, but in any case, with BBBY up more than 200% in a week on no real positive news, it seemed a good time to bet against it.

- Be conservative in your position sizing when making speculative bets with options. If you know that your loss will be manageable if you’re wrong, you’ll be less hesitant when it comes to making timely trades.

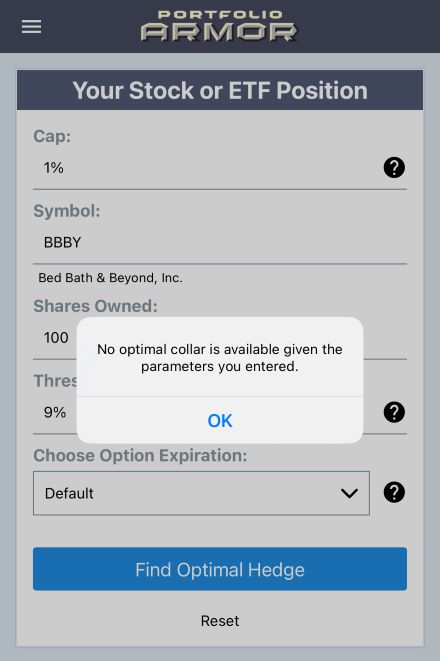

- Finally, use options market sentiment as a check on your work. If I am going to bet against a stock, I first scan for an optimal collar to hedge it against a greater-than-9% decline over the next several months, while capping its upside at 1%. I want the skew to be so great that I get the error message below.