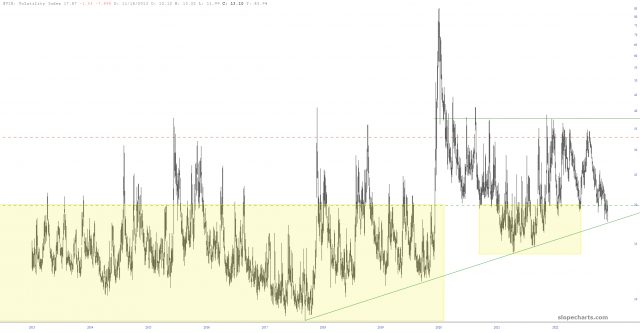

The VIX hasn’t had a 17-handle for literally over an entire year, but it managed to do so on Wednesday. Please take note of the supporting trendline it is approaching:

(more…)

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The VIX hasn’t had a 17-handle for literally over an entire year, but it managed to do so on Wednesday. Please take note of the supporting trendline it is approaching:

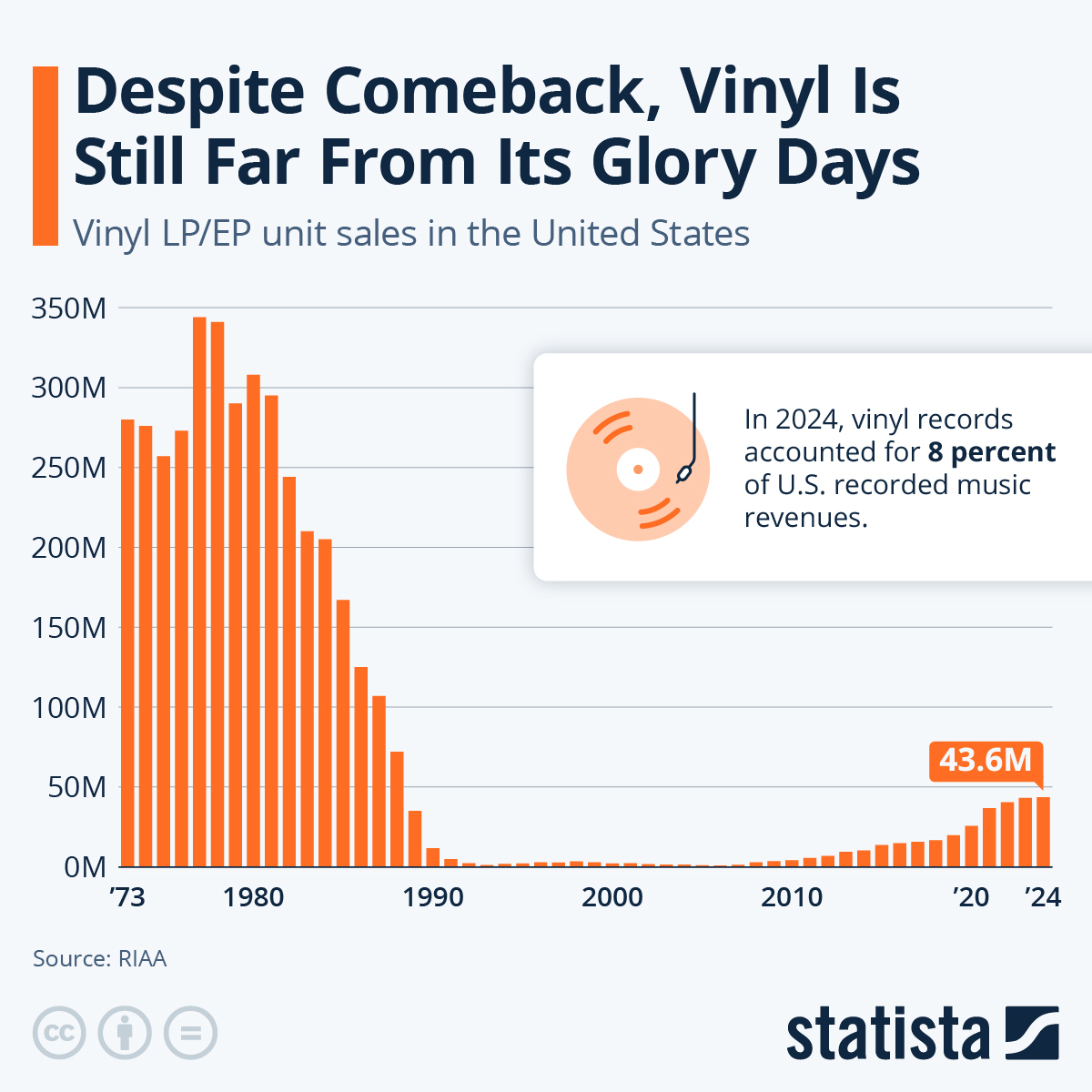

On a scale of 1 to 10, my trading confidence is hovering at about a 1.1 at the moment. Starting on January 6th (and, in a broader sense, last October 13th), this market has been absolutely sadistic to equity bears. So when does it all end? The monster earnings after Thursday’s close? The jobs report Friday morning?

I dunno. What I do feel confident of, however, is that the one screaming signal I’m waiting for is for TSLA to have the digit “2” at the start of its stock price. Assuming that happens, which will represent a 100% price increase in a period just weeks (!!!!!!!!!!) I will be vastly more comfortable deploying my cash.

I’ve had better days in my life. And weeks. And years (OK, 2023 is still young, but all the same).

Anyway, as usual, the initial reaction to the FOMC (a sudden drop) was exactly the opposite of the true outcome. More importantly, the bulls grabbed some MAJOR victories in chart-land today: Here we have the QQQ blasting away from its broken descending trendline: