Submitted by Portfolio Armor:

“Ridesharing” Company Lyft Crashes

After the close on Thursday, Lyft, Inc. (LYFT) offered grim guidance in its quarterly earnings call. Wedbush Securities’ tech analyst Dan Ivies summarized it brutally:

“In 22 years on the Street as a tech analyst we have listened to 1,000s of conference calls with many highs and lows,” wrote Wedbush analyst Daniel Ives. “Last night’s Lyft call was a Top 3 worst call we have ever heard as in our opinion as management is trying to play darts blindfolded with the expense structure going forward and gave an EBITDA [Earnings before interest, taxes, depreciation, and amortization] outlook which was a debacle for the ages.”

The next day, LYFT shares crashed 36%. The 5-day chart shows how the stock gapped down from Thursday’s close to Friday’s open.

Fortunately, LYFT was never a Portfolio Armor top name, but that chart highlights a weakness of trailing stops that I mentioned in Friday’s post: they don’t protect against these kinds of gaps down. Hedging does protect against gaps down though. Let’s look at an example of how it could have worked in this case.

Hedging LYFT On Thursday

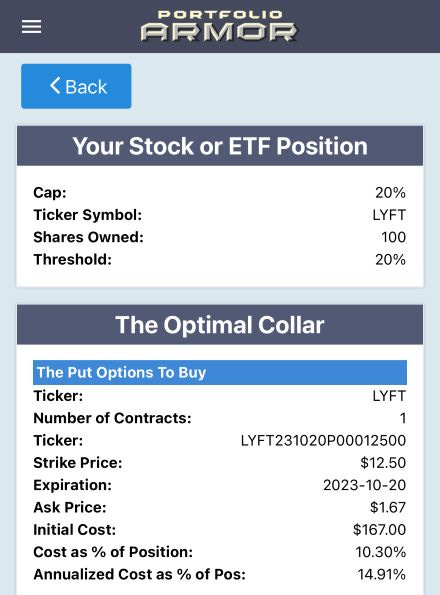

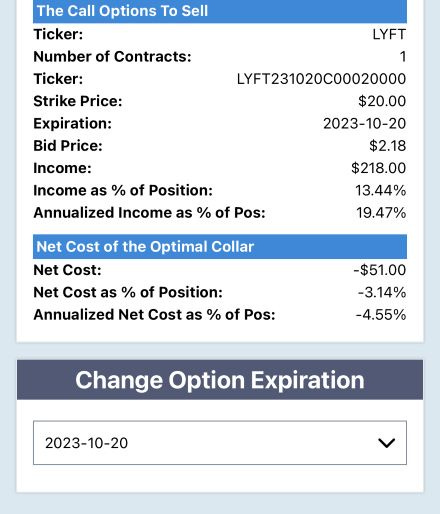

As of Thursday’s close, this was the optimal collar to hedge 100 shares of LYFT against a greater-than-20% drop by October without capping your possible upside at less than 20% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

As you can see, the cost of that hedge was slightly negative, meaning you would have collected a $51 net credit if you bought the put leg at the ask and sold the call leg at the bid (in practice, you can often buy and sell options within the spread, but we display those prices to be conservative).

How That Hedge Reacted To Friday’s Drop

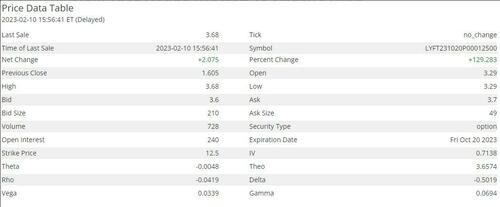

The price of those puts spiked up more than 129% to $3.68…

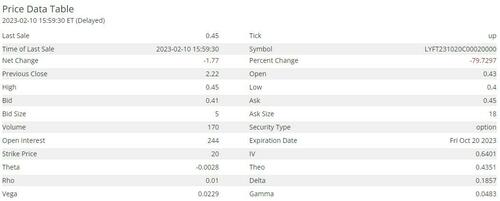

And the price of the calls dropped about 80% to $0.45.

What That Meant For A Hedged Investor

As of Thursday’s close, an investor hedged with the collar above had $1,622 in LYFT shares, $167 in LYFT puts, and if he wanted to buy-to-close his short call leg, it would have cost him $218 to do so. So, his net position value was ($1,622 + $167) – $218 = $1,571.

As of Friday’s close, LYFT shares had tanked 36%, from $16.22 to $10.31. So the investor had $1,031 in LYFT shares, $368 in LYFT puts, and it would have cost him $45 to close out his LYFT calls. So, his net position value was ($1,031 + $368) – $45 = $1,354.

$1,354 represents a 13.8% drop from $1,571. So that investor was down less than 14% instead of being down 36%.