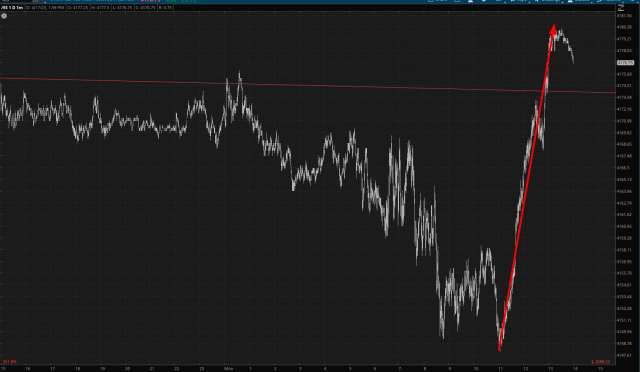

Time for me to vent………..as if you didn’t get enough of that already. I’ll start off with this one simple chart of the /ES today, because I’m really, really, really sick of this crap. An absolute explosion of buying based on absolutely no new information at all, blowing all losses away and ripping stocks into highs (with a VIX at a 16-handle, for God’s sake).

Thus, for what feels like eons now, we just keep banging out one “higher low” after another. For all practical purposes, the bear market was shot through the head on June 16, 2022.

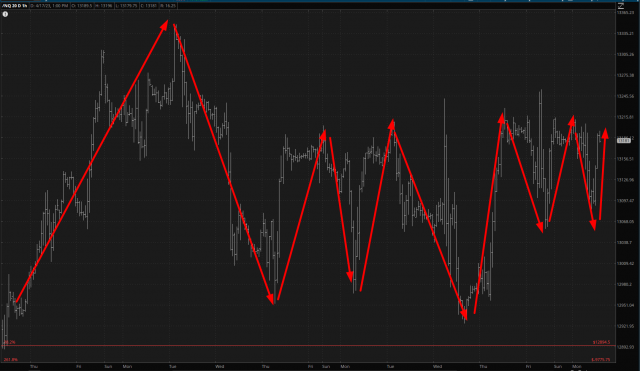

Not that everything is ripping higher without question. The /NQ, for example, has spent the last three weeks in an absolutely psychotic and ever-tightening range. Every time you sneeze, we do a 180-degree turn.

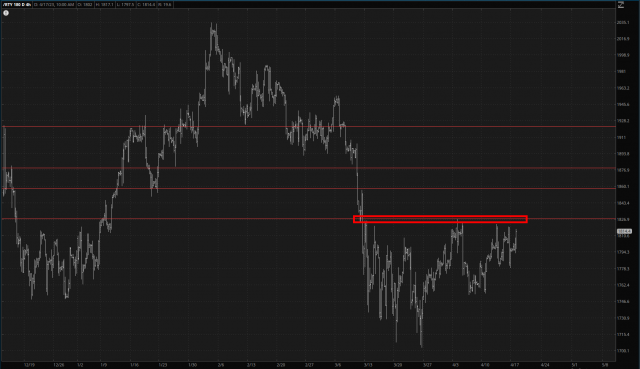

Here we see the Russell 2000 small cap futures, /RTY, is almost back up to resistance (which could change into support if it breaks above the potential bullish base).

Trading this market was an unvarnished pleasure from November 2021 through mid-June 2022. From June 2022 through mid-October 2022, it was much more challenging but still had plenty of great moments.

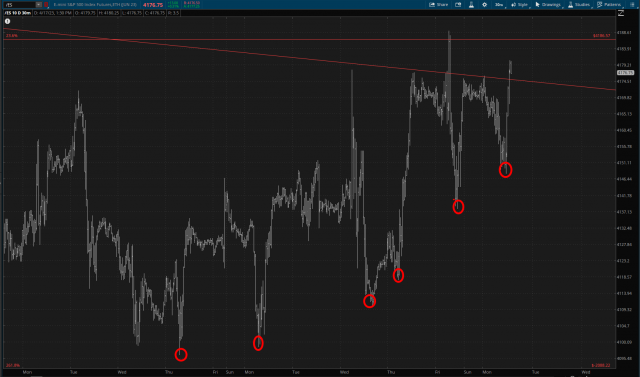

Since October 13, 2022, however, it has been one giant pain in the neck. There’s no direction. No follow-through. Just a daily circle jerk, and I get the one-two punch of not only trying to trade this barrel full of dog turds, but also having to create content about it (which, believe me, is awful at times like this).

I went from 5% cash to 20% cash on Monday, because I quickly run out of patience with positions that don’t swiftly start behaving themselves. Let’s just say I’m drawing zero pleasure from this environment, and I can only hope (there’s that word again) that the critical mass of earnings news can help give this market some direction that lasts longer than two or three hours. I’ve seriously had enough.