I’ve been spending an increasingly large amount of my time researching and exploring artificial intelligence, particularly with respect to the investing world. I stumbled upon something I didn’t know existed, which is an ETF that trades based on AI technology. Its credentials seem to be dazzling:

1,000 research analysts working around the clock! Goodness me!

It goes on………..

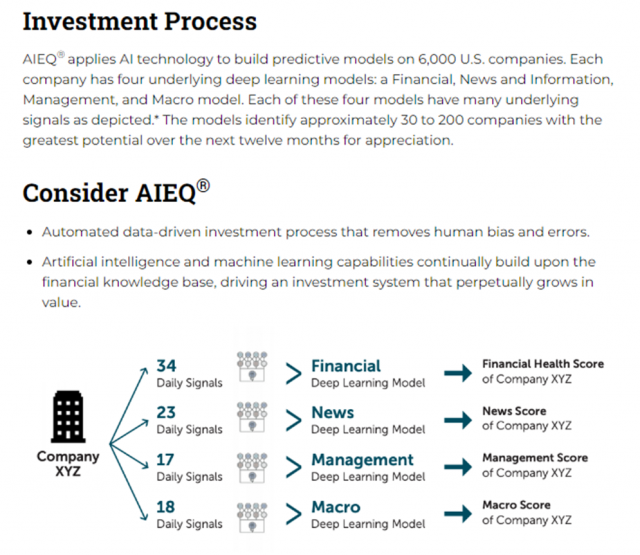

Deep learning models! Underlying signals! Financial health scores! Macro scores! The fund (symbol AIEQ) must be absolutely making bank!

So let’s check it out…………..since inception:

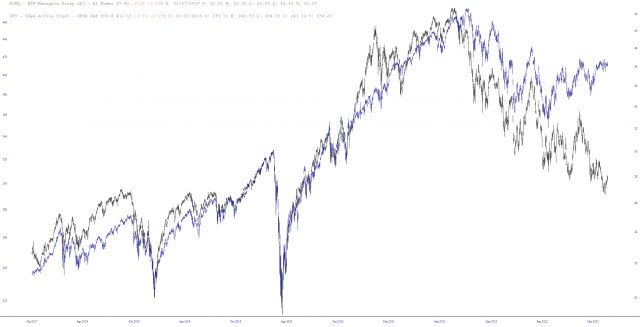

Hmm. Ummm. Well maybe it’s at least outperforming the market, right? Let’s take the most straightforward, blase, simple-minded investment in the world: the SPY.

Over the lifespan of this AI-driven fund, how has AIEQ (blue line) compared to the boring old S&P 500 ETF (shown in black):

So there you have it. Although, let’s be fair – – if 1,000 research analysts did work around-the-clock to do stock picks, this is indeed the kind of performance one might expect.

I, for one, am not impressed.